FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

2 13

EOO

I

& C

T

D

NDIVIDUAL

ORPORATE

AX

IVISION

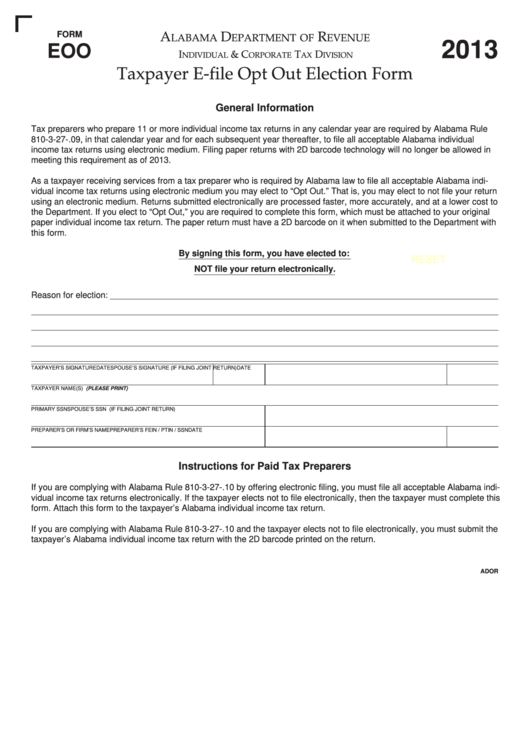

Taxpayer E-file Opt Out Election Form

General Information

Tax preparers who prepare 11 or more individual income tax returns in any calendar year are required by Alabama Rule

810-3-27-.09, in that calendar year and for each subsequent year thereafter, to file all acceptable Alabama individual

income tax returns using electronic medium. Filing paper returns with 2D barcode technology will no longer be allowed in

meeting this requirement as of 2013.

As a taxpayer receiving services from a tax preparer who is required by Alabama law to file all acceptable Alabama indi-

vidual income tax returns using electronic medium you may elect to “Opt Out.” That is, you may elect to not file your return

using an electronic medium. Returns submitted electronically are processed faster, more accurately, and at a lower cost to

the Department. If you elect to “Opt Out,” you are required to complete this form, which must be attached to your original

paper individual income tax return. The paper return must have a 2D barcode on it when submitted to the Department with

this form.

By signing this form, you have elected to:

RESET

NOT file your return electronically.

Reason for election:

TAXPAYER’S SIGNATURE

DATE

SPOUSE’S SIGNATURE (IF FILING JOINT RETURN)

DATE

TAXPAYER NAME(S) (PLEASE PRINT)

PRIMARY SSN

SPOUSE’S SSN (IF FILING JOINT RETURN)

PREPARER’S OR FIRM’S NAME

PREPARER’S FEIN / PTIN / SSN

DATE

Instructions for Paid Tax Preparers

If you are complying with Alabama Rule 810-3-27-.10 by offering electronic filing, you must file all acceptable Alabama indi-

vidual income tax returns electronically. If the taxpayer elects not to file electronically, then the taxpayer must complete this

form. Attach this form to the taxpayer’s Alabama individual income tax return.

If you are complying with Alabama Rule 810-3-27-.10 and the taxpayer elects not to file electronically, you must submit the

taxpayer’s Alabama individual income tax return with the 2D barcode printed on the return.

ADOR

1

1