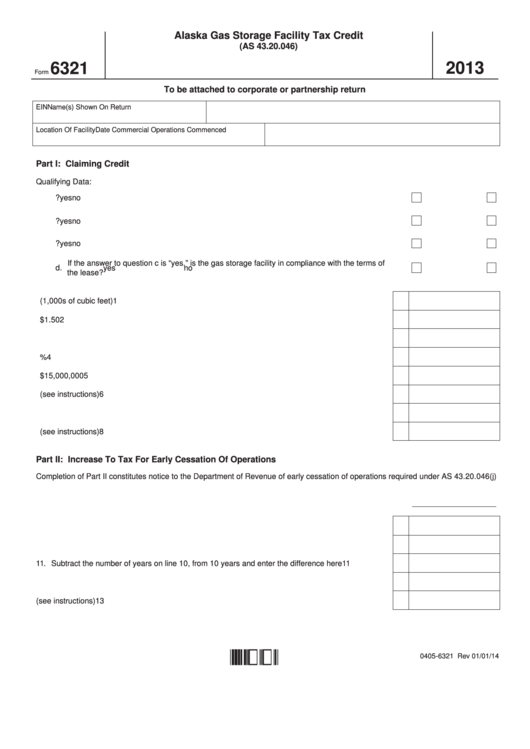

Alaska Gas Storage Facility Tax Credit

(AS 43.20.046)

6321

2013

Form

To be attached to corporate or partnership return

EIN

Name(s) Shown On Return

Location Of Facility

Date Commercial Operations Commenced

Part I: Claiming Credit

Qualifying Data:

a. Was the facility in operation as a gas storage facility before 1/1/2011?

yes

no

.

.

.

.

.

.

.

b. Is the facility regulated under AS 42.05 as a public utility?

yes

no

.

.

.

.

.

.

.

.

.

.

.

c. Is the facility located on state land and subject to a lease under AS 31.05.180?

yes

no

.

.

.

.

If the answer to question c is “yes,” is the gas storage facility in compliance with the terms of

d.

yes

no

the lease?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1. Working gas capacity of facility (1,000s of cubic feet)

1

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2. Credit available before limitations. Multiply line 1 by $1.50

2

.

.

.

.

.

.

.

.

.

.

.

.

3. Cost incurred to establish facility

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4. Credit limitation based on cost. Multiply line 3 by 25%

4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5. Overall credit limitations. Enter the lesser of line 4 or $15,000,000

5

.

.

.

.

.

.

.

.

.

.

6. Tentative credit. Enter the lesser of line 2 or line 5 (see instructions)

6

.

.

.

.

.

.

.

.

.

.

7. Credit taken in earlier tax years

7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8. Net credit available for this tax year. Subtract line 7 from line 6 (see instructions)

8

.

.

.

.

.

Part II: Increase To Tax For Early Cessation Of Operations

Completion of Part II constitutes notice to the Department of Revenue of early cessation of operations required under AS 43.20.046(j)

e. Date that commercial operations ceased

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9. Total amount of the credit taken in previous tax years

9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10. Number of years that facility was in commercial operation

10

.

.

.

.

.

.

.

.

.

.

.

.

.

11. Subtract the number of years on line 10, from 10 years and enter the difference here

11

.

.

.

.

.

12. Divide line 11 by 10

12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13. Increase to tax. Multiply line 9 by line 12 (see instructions)

13

.

.

.

.

.

.

.

.

.

.

.

.

.

6321:01 01 14

0405-6321 Rev 01/01/14

1

1