1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

4

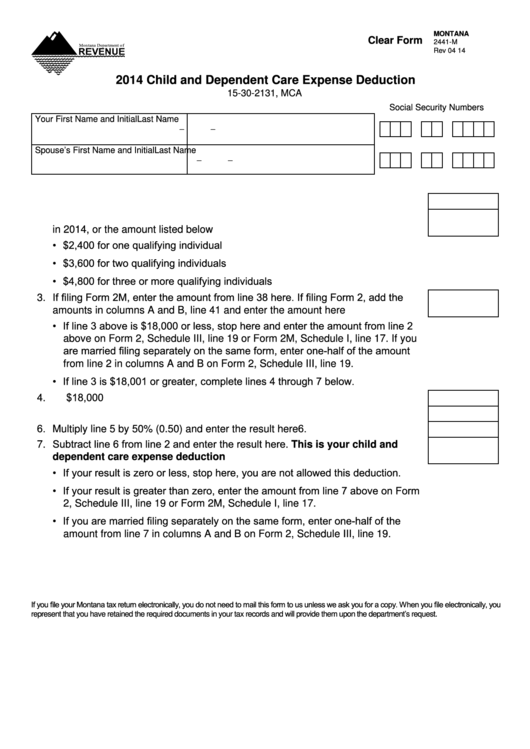

MONTANA

Clear Form

2441-M

5

5

Rev 04 14

6

6

7

7

8

8

2014 Child and Dependent Care Expense Deduction

9

9

15-30-2131, MCA

10

10

11

11

Social Security Numbers

12

12

Your First Name and Initial

Last Name

13

13

100

110

-

-

X X X - X X - X X X X

14

14

15

15

Spouse’s First Name and Initial

Last Name

16

16

130

-

-

120

17

17

18

18

19

19

20

20

1. Enter the number of qualifying individuals you cared for in 2014 ........................ 1.

140

21

21

2. Enter the lesser of your actual amount of dependent care expenses paid

22

22

150

in 2014, or the amount listed below ..................................................................... 2.

23

23

24

24

• $2,400 for one qualifying individual

25

25

• $3,600 for two qualifying individuals

26

26

27

27

• $4,800 for three or more qualifying individuals

28

28

29

29

3. If filing Form 2M, enter the amount from line 38 here. If filing Form 2, add the

160

30

30

amounts in columns A and B, line 41 and enter the amount here ....................... 3.

31

31

• If line 3 above is $18,000 or less, stop here and enter the amount from line 2

32

32

33

33

above on Form 2, Schedule III, line 19 or Form 2M, Schedule I, line 17. If you

34

34

are married filing separately on the same form, enter one-half of the amount

35

35

from line 2 in columns A and B on Form 2, Schedule III, line 19.

36

36

37

37

• If line 3 is $18,001 or greater, complete lines 4 through 7 below.

38

38

$18,000

39

39

4. Your Montana adjusted gross income base amount is entered here .................. 4.

170

40

40

180

5. Subtract line 4 from line 3 and enter the result here............................................ 5.

41

41

6. Multiply line 5 by 50% (0.50) and enter the result here ....................................... 6.

42

42

190

43

43

7. Subtract line 6 from line 2 and enter the result here. This is your child and

200

44

44

dependent care expense deduction ................................................................ 7.

45

45

46

• If your result is zero or less, stop here, you are not allowed this deduction.

46

47

47

• If your result is greater than zero, enter the amount from line 7 above on Form

48

48

49

49

2, Schedule III, line 19 or Form 2M, Schedule I, line 17.

50

50

• If you are married filing separately on the same form, enter one-half of the

51

51

52

52

amount from line 7 in columns A and B on Form 2, Schedule III, line 19.

53

53

54

54

55

55

56

56

57

57

58

58

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

59

59

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

60

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2