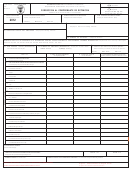

Arizona Form

2012 Arizona Charitable Withholding Statement

A1-C

December 31, 2012) or within 15 days of termination of an

Obtain additional information or assistance by calling one of

employee whose withholding was reduced. The annual

the numbers listed below:

statement is due by January 30 of the year following the

Phoenix

(602) 255-2060

calendar year in which donations were withheld. If the due

From area codes 520 and 928, toll-free

(800) 843-7196

date falls on a Saturday, Sunday, or legal holiday, the

Hearing impaired TDD user

statement is considered timely if it is filed by the next day

Phoenix

(602) 542-4021

that is not a Saturday, Sunday, or legal holiday. Send the

From area codes 520 and 928, toll-free

(800) 397-0256

statement to the Arizona Department of Revenue, Office of

Obtain tax rulings, tax procedures, tax forms and instructions,

Economic Research and Analysis, PO Box 25248, Phoenix

and other tax information by accessing the department's

AZ 85002-5248.

Internet home page at

Filing Amended Statements

NOTE: Arizona Form A1-C for calendar year 2012 is due

If this is an amended Form A1-C, check the amended

January 30, 2013. Do not mail Form A1-C with any other

statement box. Enter the amended numbers in all areas of the

withholding form. Be sure to mail Form A1-C to the correct

form, and explain why an amended statement is being filed in

address: Arizona Department of Revenue, Office of Economic

the space provided. Include amended detail forms with the

Research and Analysis, PO BOX 25248, Phoenix, AZ 85002.

amended statement. Check the "Corrected" box on the

amended individual statements.

General Instructions

Specific Instructions

Beginning January 1, 2010, an employee can request that his

or her employer reduce his or her withholding in an amount

Type or print the name, address, and phone number in the

equal to income tax credit(s) the employee will qualify for

boxes in the Employer Information section. Check the boxes

when filing the employee's income tax return. Only the

to indicate whether this statement is an amended statement,

following credits qualify for the reduction in withholding:

and whether the address of the employer has changed.

contributions to charities that provide assistance to the

Enter the employer identification number (EIN) where indicated

working poor, provided by ARS § 43-1088 and

to the right of the employer's name and address.

claimed on Arizona Form 321;

All returns, statements, and other documents filed with the

contributions made or fees paid to public schools,

department require a taxpayer identification number (TIN).

provided by ARS § 43-1089.01 and claimed on

Taxpayers that fail to include their TIN may be subject to a

Arizona Form 322; and

penalty. Paid tax return preparers must include their TIN

contributions to private school tuition organizations,

where requested. The TIN for a paid tax return preparer is the

provided by ARS § 43-1089 and claimed on Arizona

individual's social security number, preparer tax identification

Form 323.

number, or the employer identification number of the

Who Must File Form A1-C

business. Paid tax return preparers that fail to include their

TIN may be subject to a penalty.

Employers that make payments of the reduced withholding of

Fill out one individual Charitable Withholding Statement in

its employees to charitable organizations as provided by ARS

Section II for each charity that each employee had the

§ 43-401(I)(1) must file Form A1-C, Arizona Charitable

employer make payments to on behalf of the employee. There

Withholding Statement, to report the information required by

may be several individual Charitable Withholding Statements

ARS § 43-401(I)(4). Form A1-C is also the Arizona transmittal

for each charity and for each employee. Attach continuation

statement for detail forms. These detail forms are required to be

sheet(s), if necessary. Make sure the employer's name and

filed with the Form A1-C as an integral part of the statement

EIN are included on the top of each continuation sheet.

required by the statute.

Instead of completing the individual Charitable Withholding

Instead of completing the individual Charitable Withholding

Statements, employers may substitute their own schedule as

Statements, employers may substitute their own schedule as

long as it contains the same information.

long as it contains the same information.

Box 1 - Employee Contributions Made in 2012

NOTE: Employers that file Form A1-C must still file either Form

A1-APR, Arizona Annual Payment Withholding Tax Return, or

Include the amount of reduced withholding paid to the

Form A1-R, Arizona Withholding Reconciliation Return, to

employee's chosen charity. Do not round the amount paid.

reconcile their payments and transmit federal Forms W-2, W-2c,

Box 2 - Termination Date

W-2G, and/or 1099-R, if those forms include Arizona withholding.

Mail each form to the address on the form, by the correct due date.

Enter the termination date of the employee, if applicable.

Filing Original Statements

Provide a copy of the Individual Charitable Withholding

Statement to the employee. Maintain a copy of the statements

This statement must be filed annually, on a calendar year

for the employer's records.

basis (i.e., for the period January 1, 2012, through

Print Page

1

1 2

2 3

3