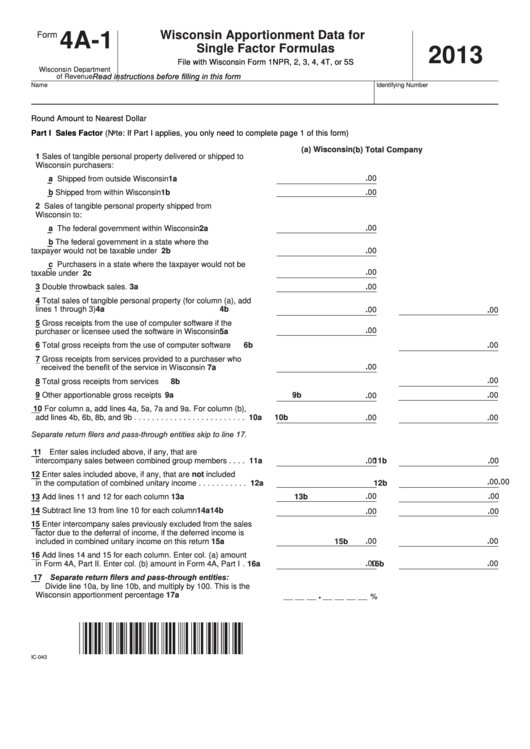

Form 4a-1 - Wisconsin Apportionment Data For Single Factor Formulas - 2013

ADVERTISEMENT

Wisconsin Apportionment Data for

4A-1

Form

Single Factor Formulas

2013

File with Wisconsin Form 1NPR, 2, 3, 4, 4T, or 5S

Wisconsin Department

Read instructions before filling in this form

of Revenue

Name

Identifying Number

Round Amount to Nearest Dollar

Part I Sales Factor (Note: If Part I applies, you only need to complete page 1 of this form)

(a) Wisconsin

(b) Total Company

1 Sales of tangible personal property delivered or shipped to

Wisconsin purchasers:

.00

a Shipped from outside Wisconsin . . . . . . . . . . . . . . . . . . . . 1a

b Shipped from within Wisconsin . . . . . . . . . . . . . . . . . . . . . . 1b

.00

2 Sales of tangible personal property shipped from

Wisconsin to:

.00

a The federal government within Wisconsin . . . . . . . . . . . . . 2a

b The federal government in a state where the

taxpayer would not be taxable under P .L . 86-272 . . . . . . . . 2b

.00

c Purchasers in a state where the taxpayer would not be

.00

taxable under P .L . 86-272 . . . . . . . . . . . . . . . . . . . . . . . . . . 2c

3 Double throwback sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

.00

4 Total sales of tangible personal property (for column (a), add

lines 1 through 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

4b

.00

.00

5 Gross receipts from the use of computer software if the

.00

purchaser or licensee used the software in Wisconsin . . . . . . 5a

6 Total gross receipts from the use of computer software . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

.00

7 Gross receipts from services provided to a purchaser who

received the benefit of the service in Wisconsin . . . . . . . . . . . 7a

.00

.00

8 Total gross receipts from services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8b

9 Other apportionable gross receipts . . . . . . . . . . . . . . . . . . . . . 9a

9b

.00

.00

10 For column a, add lines 4a, 5a, 7a and 9a . For column (b),

add lines 4b, 6b, 8b, and 9b . . . . . . . . . . . . . . . . . . . . . . . . . 10a

10b

.00

.00

Separate return filers and pass-through entities skip to line 17.

11

Enter sales included above, if any, that are

intercompany sales between combined group members . . . . 11a

.00

11b

.00

12 Enter sales included above, if any, that are not included

.00

.00

in the computation of combined unitary income . . . . . . . . . . . 12a

12b

.00

.00

13 Add lines 11 and 12 for each column . . . . . . . . . . . . . . . . . . . 13a

13b

14 Subtract line 13 from line 10 for each column . . . . . . . . . . . . . 14a

14b

.00

.00

15 Enter intercompany sales previously excluded from the sales

factor due to the deferral of income, if the deferred income is

.00

.00

included in combined unitary income on this return . . . . . . . . 15a

15b

16 Add lines 14 and 15 for each column . Enter col . (a) amount

in Form 4A, Part II . Enter col . (b) amount in Form 4A, Part I . 16a

.00

16b

.00

17 Separate return filers and pass-through entities:

Divide line 10a, by line 10b, and multiply by 100 . This is the

.

Wisconsin apportionment percentage . . . . . . . . . . . . . . . . . . . 17a

%

IC-043

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4