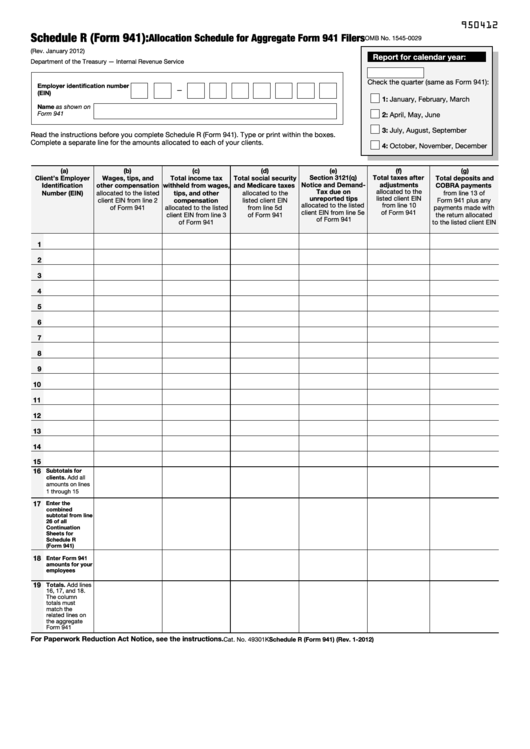

950412

Schedule R (Form 941):

Allocation Schedule for Aggregate Form 941 Filers

OMB No. 1545-0029

(Rev. January 2012)

Report for calendar year:

Department of the Treasury — Internal Revenue Service

Check the quarter (same as Form 941):

Employer identification number

—

(EIN)

1: January, February, March

Name as shown on

Form 941

2: April, May, June

3: July, August, September

Read the instructions before you complete Schedule R (Form 941). Type or print within the boxes.

Complete a separate line for the amounts allocated to each of your clients.

4: October, November, December

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Section 3121(q)

Total taxes after

Client’s Employer

Wages, tips, and

Total income tax

Total social security

Total deposits and

Notice and Demand-

adjustments

Identification

other compensation

withheld from wages,

and Medicare taxes

COBRA payments

Tax due on

allocated to the

Number (EIN)

tips, and other

allocated to the listed

allocated to the

from line 13 of

unreported tips

listed client EIN

client EIN from line 2

compensation

listed client EIN

Form 941 plus any

allocated to the listed

from line 10

of Form 941

allocated to the listed

from line 5d

payments made with

client EIN from line 5e

of Form 941

client EIN from line 3

of Form 941

the return allocated

of Form 941

of Form 941

to the listed client EIN

.

.

.

.

.

.

1

.

.

.

.

.

.

2

.

.

.

.

.

.

3

.

.

.

.

.

.

4

.

.

.

.

.

.

5

.

.

.

.

.

.

6

.

.

.

.

.

.

7

.

.

.

.

.

.

8

.

.

.

.

.

.

9

.

.

.

.

.

.

10

.

.

.

.

.

.

11

.

.

.

.

.

.

12

.

.

.

.

.

.

13

.

.

.

.

.

.

14

.

.

.

.

.

.

15

16

Subtotals for

clients. Add all

.

.

.

.

.

.

amounts on lines

1 through 15

17

Enter the

combined

subtotal from line

26 of all

Continuation

Sheets for

.

.

.

.

.

.

Schedule R

(Form 941)

18

Enter Form 941

amounts for your

.

.

.

.

.

.

employees

19

Totals. Add lines

16, 17, and 18.

The column

totals must

match the

related lines on

.

.

.

.

.

.

the aggregate

Form 941

For Paperwork Reduction Act Notice, see the instructions.

Cat. No. 49301K

Schedule R (Form 941) (Rev. 1-2012)

1

1 2

2 3

3