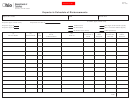

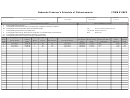

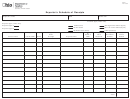

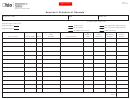

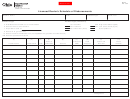

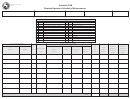

EX 2-2

Instructions for Exporter’s Schedule of Disbursements

Rev. 4/09

Page 2

This schedule provides detail in support of the amount(s) shown as disbursements

was exported. If you export to multiple states, you must submit a separate schedule

on the exporter’s reconciliation reports.

for each state. A duplicate schedule must be submitted for each state of exportation.

Each disbursement of fuel must be listed on a separate line.

Column Instructions

Like purchasers should be grouped together and a gallonage subtotal by purchaser

Column 1

Enter the name of the company that transports the fuel.

must be provided.

Column 2

Enter the FEIN of the company that transports the fuel.

Insert in the appropriate box your company name, FEIN and month and year of the

report.

Column 3

Enter the mode of transport. Use one of the following letters: J=Truck;

R=Rail; B=Barge; P=Pipeline; S=Ship

Exporter Type

Column 4

Enter the city and state to where the fuel was transported. If fuel is

Place a check mark next to the type of exporter license you have.

transported to a terminal, use the uniform terminal code.

Column 5

Enter the name of the purchaser of the fuel.

Product Type

Column 6

Enter the purchaser’s FEIN.

On the face of the schedule, place a check mark next to the product type being

reported on the schedule. IMPORTANT – All No. 1 distillate products that are

Column 7

Enter the date the fuel was shipped.

“dyed,” regardless of their name, are to be reported under product code No. 226

(high sulfur diesel-dyed) or No. 227 (low sulfur diesel-dyed). All No. 1 distillate

Column 8

Enter the document number identifying the fuel. In the case of fuel

products that are “undyed” (this includes AVJET fuel), regardless of their name,

disbursed from a terminal, use the bill of lading (shipping document)

are to be reported under product code 142 (kerosene). You must file a separate

number. For fuel disbursed from a bulk plant, use the invoice number.

schedule for each product type.

Column 9

Enter the gross gallons disbursed.

Special Instructions

Insert in the space provided on the front of the schedule the state to which the fuel

1

1 2

2