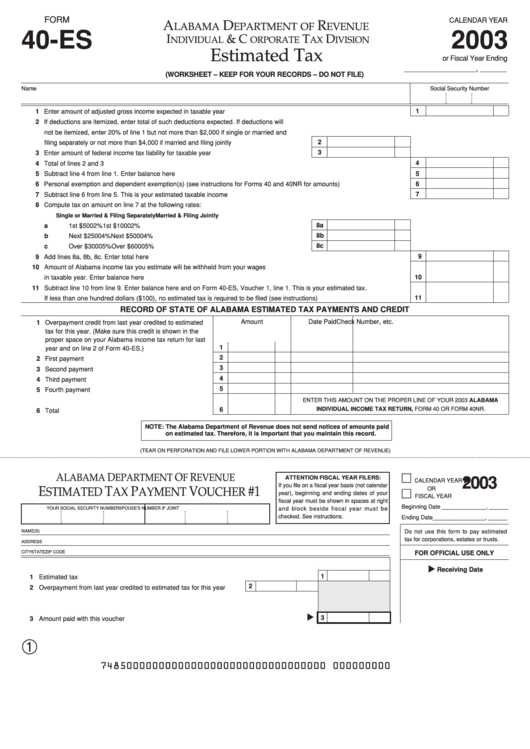

Form 40es - Estimated Tax - 2003

ADVERTISEMENT

FORM

CALENDAR YEAR

A

D

R

LABAMA

EP ARTMENT OF

EVENUE

40-ES

2003

I

& C

T

D

NDIVIDUAL

ORPORATE

AX

IVISION

Estimated Tax

or Fiscal Year Ending

___________________, _______

(WORKSHEET – KEEP FOR YOUR RECORDS – DO NOT FILE)

Name

Social Security Number

1

1 Enter amount of adjusted gross income expected in taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 If deductions are itemized, enter total of such deductions expected. If deductions will

not be itemized, enter 20% of line 1 but not more than $2,000 if single or married and

2

filing separately or not more than $4,000 if married and filing jointly . . . . . . . . . . . . . . . . . . . .

3 Enter amount of federal income tax liability for taxable year . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Total of lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Subtract line 4 from line 1. Enter balance here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Personal exemption and dependent exemption(s) (see instructions for Forms 40 and 40NR for amounts) . . . . . . . . . . . . . . . . . .

6

7

7 Subtract line 6 from line 5. This is your estimated taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Compute tax on amount on line 7 at the following rates:

Single or Married & Filing Separately

Married & Filing Jointly

8a

a

1st $500

2%

1st $1000

2%. . . . . . . . . . . . .

8b

b

Next $2500

4%

Next $5000

4%. . . . . . . . . . . . .

8c

c

Over $3000

5%

Over $6000

5%. . . . . . . . . . . . .

9 Add lines 8a, 8b, 8c. Enter total here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Amount of Alabama income tax you estimate will be withheld from your wages

10

in taxable year. Enter balance here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Subtract line 10 from line 9. Enter balance here and on Form 40-ES, Voucher 1, line 1. This is your estimated tax.

11

If less than one hundred dollars ($100), no estimated tax is required to be filed (see instructions). . . . . . . . . . . . . . . . . . . . . . . . .

RECORD OF STATE OF ALABAMA ESTIMATED TAX PAYMENTS AND CREDIT

Amount

Date Paid

Check Number, etc.

1 Overpayment credit from last year credited to estimated

tax for this year. (Make sure this credit is shown in the

proper space on your Alabama income tax return for last

1

year and on line 2 of Form 40-ES.). . . . . . . . . . . . . . . . . .

2

2 First payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Second payment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Third payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Fourth payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ENTER THIS AMOUNT ON THE PROPER LINE OF YOUR 2003 ALABAMA

INDIVIDUAL INCOME TAX RETURN, FORM 40 OR FORM 40NR.

6

6 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: The Alabama Department of Revenue does not send notices of amounts paid

on estimated tax. Therefore, it is important that you maintain this record.

(TEAR ON PERFORATION AND FILE LOWER PORTION WITH ALABAMA DEPARTMENT OF REVENUE)

A

D

O

R

LABAMA

EPARTMENT

F

EVENUE

2003

ATTENTION FISCAL YEAR FILERS:

CALENDAR YEAR

If you file on a fiscal year basis (not calendar

OR

E

T

P

V

#1

STIMATED

AX

AYMENT

OUCHER

year), beginning and ending dates of your

FISCAL YEAR

fiscal year must be shown in spaces at right

Beginning Date ______________, ______

YOUR SOCIAL SECURITY NUMBER

SPOUSE’S NUMBER IF JOINT

and block beside fiscal year must be

checked. See instructions.

Ending Date _________________, ______

Do not use this form to pay estimated

NAME(S)

tax for corporations, estates or trusts.

ADDRESS

CITY

STATE

ZIP CODE

FOR OFFICIAL USE ONLY

Receiving Date

1

1 Estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Overpayment from last year credited to estimated tax for this year . . . .

3

3 Amount paid with this voucher . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

74850000000000000000000000000000000 000000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2