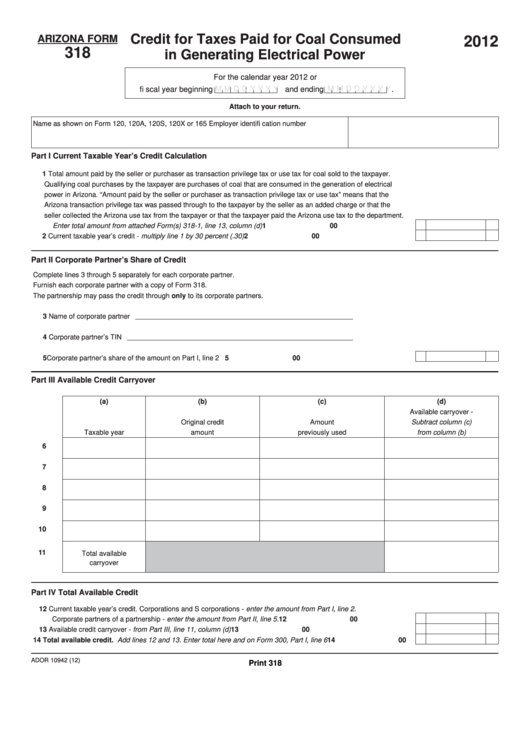

Credit for Taxes Paid for Coal Consumed

ARIZONA FORM

2012

318

in Generating Electrical Power

For the calendar year 2012 or

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

Attach to your return.

Name as shown on Form 120, 120A, 120S, 120X or 165

Employer identifi cation number

Part I

Current Taxable Year’s Credit Calculation

1 Total amount paid by the seller or purchaser as transaction privilege tax or use tax for coal sold to the taxpayer.

Qualifying coal purchases by the taxpayer are purchases of coal that are consumed in the generation of electrical

power in Arizona. “Amount paid by the seller or purchaser as transaction privilege tax or use tax” means that the

Arizona transaction privilege tax was passed through to the taxpayer by the seller as an added charge or that the

seller collected the Arizona use tax from the taxpayer or that the taxpayer paid the Arizona use tax to the department.

Enter total amount from attached Form(s) 318-1, line 13, column (d) ..............................................................................

1

00

2 Current taxable year’s credit - multiply line 1 by 30 percent (.30) ....................................................................................

2

00

Part II

Corporate Partner’s Share of Credit

Complete lines 3 through 5 separately for each corporate partner.

Furnish each corporate partner with a copy of Form 318.

The partnership may pass the credit through only to its corporate partners.

3 Name of corporate partner

4 Corporate partner’s TIN

5 Corporate partner’s share of the amount on Part I, line 2 ...............................................................................................

5

00

Part III Available Credit Carryover

(a)

(b)

(c)

(d)

Available carryover -

Original credit

Amount

Subtract column (c)

Taxable year

amount

previously used

from column (b)

6

7

8

9

10

11

Total available

carryover

Part IV Total Available Credit

12 Current taxable year’s credit. Corporations and S corporations - enter the amount from Part I, line 2.

Corporate partners of a partnership - enter the amount from Part II, line 5. ..................................................................... 12

00

13 Available credit carryover - from Part III, line 11, column (d) ............................................................................................ 13

00

14 Total available credit. Add lines 12 and 13. Enter total here and on Form 300, Part I, line 6 ....................................... 14

00

ADOR 10942 (12)

Print 318

1

1 2

2