Marital Property Valuation - 401(A) Defined Benefit Account - Oklahoma Teachers Retirement System

ADVERTISEMENT

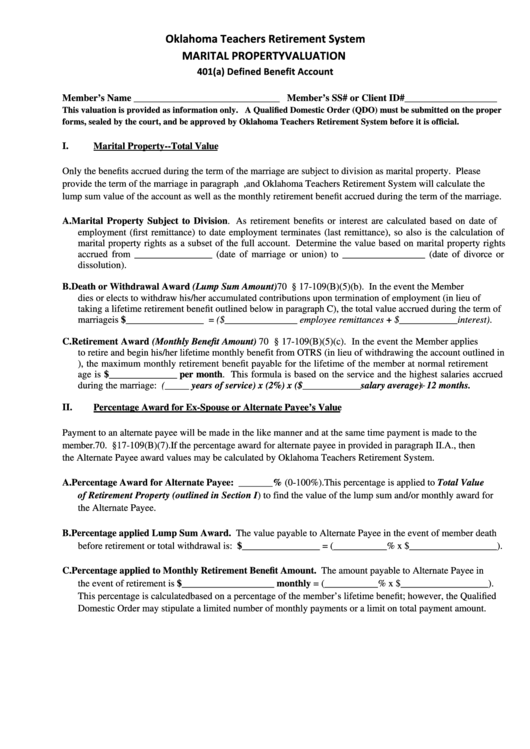

Oklahoma Teachers Retirement System

MARITAL PROPERTY VALUATION

401(a) Defined Benefit Account

Member’s Name ______________________________ Member’s SS# or Client ID#___________________

This valuation is provided as information only. A Qualified Domestic Order (QDO) must be submitted on the proper

forms, sealed by the court, and be approved by Oklahoma Teachers Retirement System before it is official.

I.

Marital Property--Total Value

Only the benefits accrued during the term of the marriage are subject to division as marital property. Please

provide the term of the marriage in paragraph I.A., and Oklahoma Teachers Retirement System will calculate the

lump sum value of the account as well as the monthly retirement benefit accrued during the term of the marriage.

A. Marital Property Subject to Division. As retirement benefits or interest are calculated based on date of

employment (first remittance) to date employment terminates (last remittance), so also is the calculation of

marital property rights as a subset of the full account. Determine the value based on marital property rights

accrued from ________________ (date of marriage or union) to _________________ (date of divorce or

dissolution).

B. Death or Withdrawal Award (Lump Sum Amount) 70 O.S. § 17-109(B)(5)(b). In the event the Member

dies or elects to withdraw his/her accumulated contributions upon termination of employment (in lieu of

taking a lifetime retirement benefit outlined below in paragraph C), the total value accrued during the term of

marriage is $________________ = ($_______________ employee remittances + $____________interest).

C. Retirement Award (Monthly Benefit Amount) 70 O.S. § 17-109(B)(5)(c). In the event the Member applies

to retire and begin his/her lifetime monthly benefit from OTRS (in lieu of withdrawing the account outlined in

II.B.), the maximum monthly retirement benefit payable for the lifetime of the member at normal retirement

age is $______________ per month. This formula is based on the service and the highest salaries accrued

during the marriage: (_____ years of service) x (2%) x ($____________salary average)

12 months.

II.

Percentage Award for Ex-Spouse or Alternate Payee’s Value

Payment to an alternate payee will be made in the like manner and at the same time payment is made to the

member. 70. O.S. §17-109(B)(7). If the percentage award for alternate payee in provided in paragraph II.A., then

the Alternate Payee award values may be calculated by Oklahoma Teachers Retirement System.

A. Percentage Award for Alternate Payee: _______% (0-100%). This percentage is applied to Total Value

of Retirement Property (outlined in Section I) to find the value of the lump sum and/or monthly award for

the Alternate Payee.

B. Percentage applied Lump Sum Award. The value payable to Alternate Payee in the event of member death

before retirement or total withdrawal is: $________________ = (___________% x $__________________).

C. Percentage applied to Monthly Retirement Benefit Amount. The amount payable to Alternate Payee in

the event of retirement is $___________________ monthly = (___________% x $__________________).

This percentage is calculated based on a percentage of the member’s lifetime benefit; however, the Qualified

Domestic Order may stipulate a limited number of monthly payments or a limit on total payment amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8