3

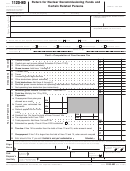

Form 990-BL (Rev. 12-2011)

Page

Schedule A—Initial Excise Taxes on Black Lung Benefit Trusts and Certain Related Persons

Under sections 4951 and 4952 of the Internal Revenue Code

NOT OPEN FOR PUBLIC INSPECTION

For the calendar year

, or fiscal year beginning

,

, and ending

,

Name of trust/person filing return (see instructions)

EIN or SSN of filer (see instructions)

Name of related section 501(c)(21) trust (if applicable)

Return filed by (see instructions, check box that applies):

Trust

Trustee

Disqualified person

Part I

Initial Taxes on Self-dealing (Section 4951) and Taxable Expenditures (Section 4952)

SECTION A—Acts of Self-dealing and Tax Computation (Section 4951)

(a) Act

(b) Date of act

(c) Description of act

number

1

2

3

4

(d) Names of disqualified persons liable for tax

(e) Names of trustees liable for tax

(g) Initial tax on self-dealing disqualified person

(h) Tax on trustee (if applicable)

(f) Amount involved in act

(10% of column (f))

(2½% of column (f))

Total (add lines 1 through 4,

columns (g) and (h)) .

.

.

.

.

.

▶

SECTION B—Taxable Expenditures and Tax Computation (Section 4952)

(a) Item

(c) Date paid

(e) Description of expenditure and

(b) Amount

(d) Name and address of recipient

number

or incurred

purposes for which made

1

2

3

4

(h) Tax imposed on

(g) Tax imposed on trust

trustee (if applicable)

(f) Names of trustees liable for tax

(10% of column (b))

(2½% of column (b))

Total (Add lines 1 through 4, columns (g) and (h)) .

.

.

.

.

.

.

.

.

.

.

▶

Part II

Summary of Taxes

1

Enter amount of section 4951 tax on disqualified person from Part I, Section A, column (g)

1

2

Enter amount of section 4951 tax on trustee from Part I, Section A, column (h) .

2

.

.

.

.

.

3

Enter amount of section 4952 tax on trust from Part I, Section B, column (g) .

.

.

.

.

.

.

3

4

Enter amount of section 4952 tax on trustee from Part I, Section B, column (h) .

.

.

.

.

.

4

5

Total tax due (add lines 1 through 4) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

▶

990-BL

Form

(Rev. 12-2011)

1

1 2

2 3

3