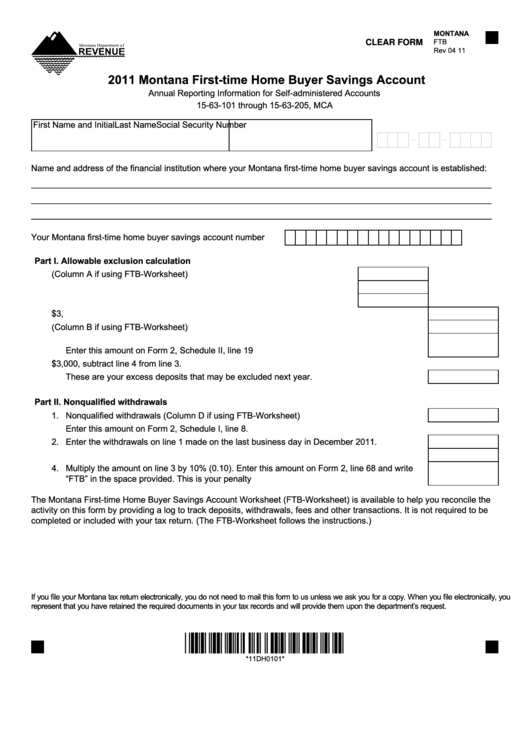

MONTANA

FTB

CLEAR FORM

Rev 04 11

2011 Montana First-time Home Buyer Savings Account

Annual Reporting Information for Self-administered Accounts

15-63-101 through 15-63-205, MCA

First Name and Initial

Last Name

Social Security Number

-

-

Name and address of the financial institution where your Montana first-time home buyer savings account is established:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Your Montana first-time home buyer savings account number

Part I. Allowable exclusion calculation

1. Current year deposits (Column A if using FTB-Worksheet) ........................ 1.

2. Deposits from prior years not previously excluded ..................................... 2.

3. Add lines 1 and 2 ........................................................................................ 3.

4. Enter the lesser of the amount on line 3 or $3,000...................................................................4.

5. Interest and other income (Column B if using FTB-Worksheet) ...............................................5.

6. Add lines 4 and 5. This is your Montana First-time Home Buyer Savings Account exclusion.

Enter this amount on Form 2, Schedule II, line 19 ...................................................................6.

7. If the amount on line 3 is greater than $3,000, subtract line 4 from line 3.

These are your excess deposits that may be excluded next year. ...........................................7.

Part II. Nonqualified withdrawals

1. Nonqualified withdrawals (Column D if using FTB-Worksheet) ................................................1.

Enter this amount on Form 2, Schedule I, line 8.

2. Enter the withdrawals on line 1 made on the last business day in December 2011. ................2.

3. Subtract line 2 from line 1 .........................................................................................................3.

4. Multiply the amount on line 3 by 10% (0.10). Enter this amount on Form 2, line 68 and write

“FTB” in the space provided. This is your penalty ....................................................................4.

The Montana First-time Home Buyer Savings Account Worksheet (FTB-Worksheet) is available to help you reconcile the

activity on this form by providing a log to track deposits, withdrawals, fees and other transactions. It is not required to be

completed or included with your tax return. (The FTB-Worksheet follows the instructions.)

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*11DH0101*

*11DH0101*

1

1 2

2 3

3