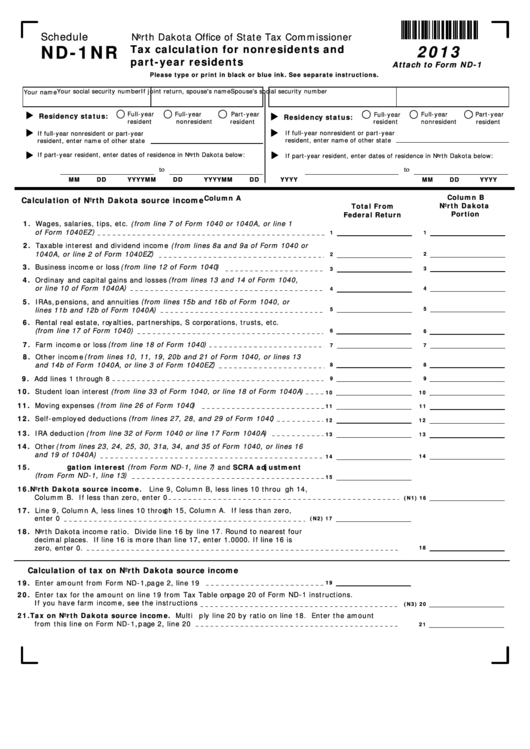

Schedule

North Dakota Office of State Tax Commissioner

ND-1NR

2013

Tax calculation for nonresidents and

part-year residents

Attach to Form ND-1

Please type or print in black or blue ink. See separate instructions.

Your social security number

If joint return, spouse's name

Spouse's social security number

Your name

Full-year

Full-year

Part-year

Full-year

Full-year

Part-year

Residency status:

Residency status:

resident

nonresident

resident

resident

nonresident

resident

If full-year nonresident or part-year

If full-year nonresident or part-year

resident, enter name of other state

resident, enter name of other state

If part-year resident, enter dates of residence in North Dakota below:

If part-year resident, enter dates of residence in North Dakota below:

to

to

MM

DD

YYYY

MM

DD

YYYY

MM

DD

YYYY

MM

DD

YYYY

Column B

Column A

Calculation of North Dakota source income

North Dakota

Total From

Portion

Federal Return

1. Wages, salaries, tips, etc. (from line 7 of Form 1040 or 1040A, or line 1

of Form 1040EZ)

1

1

2. Taxable interest and dividend income (from lines 8a and 9a of Form 1040 or

1040A, or line 2 of Form 1040EZ)

2

2

3. Business income or loss (from line 12 of Form 1040)

3

3

4. Ordinary and capital gains and losses (from lines 13 and 14 of Form 1040,

or line 10 of Form 1040A)

4

4

5. IRAs, pensions, and annuities (from lines 15b and 16b of Form 1040, or

lines 11b and 12b of Form 1040A)

5

5

6. Rental real estate, royalties, partnerships, S corporations, trusts, etc.

(from line 17 of Form 1040)

6

6

7. Farm income or loss (from line 18 of Form 1040)

7

7

8. Other income (from lines 10, 11, 19, 20b and 21 of Form 1040, or lines 13

and 14b of Form 1040A, or line 3 of Form 1040EZ)

8

8

9. Add lines 1 through 8

9

9

10. Student loan interest (from line 33 of Form 1040, or line 18 of Form 1040A)

10

10

11. Moving expenses (from line 26 of Form 1040)

11

11

12. Self-employed deductions (from lines 27, 28, and 29 of Form 1040)

12

12

13. IRA deduction (from line 32 of Form 1040 or line 17 Form 1040A)

13

13

14. Other (from lines 23, 24, 25, 30, 31a, 34, and 35 of Form 1040, or lines 16

and 19 of 1040A)

14

14

15. U.S. obligation interest (from Form ND-1, line 7) and SCRA adjustment

(from Form ND-1, line 13)

15

16. North Dakota source income.

Line 9, Column B, less lines 10 through 14,

Columm B. If less than zero, enter 0

(N1) 16

17. Line 9, Column A, less lines 10 through 15, Column A. If less than zero,

enter 0

(N2) 17

18. North Dakota income ratio. Divide line 16 by line 17. Round to nearest four

decimal places. If line 16 is more than line 17, enter 1.0000. If line 16 is

zero, enter 0.

18

Calculation of tax on North Dakota source income

19. Enter amount from Form ND-1, page 2, line 19

19

20. Enter tax for the amount on line 19 from Tax Table on page 20 of Form ND-1 instructions.

If you have farm income, see the instructions

(N3) 20

21. Tax on North Dakota source income. Multiply line 20 by ratio on line 18. Enter the amount

from this line on Form ND-1, page 2, line 20

21

1

1 2

2