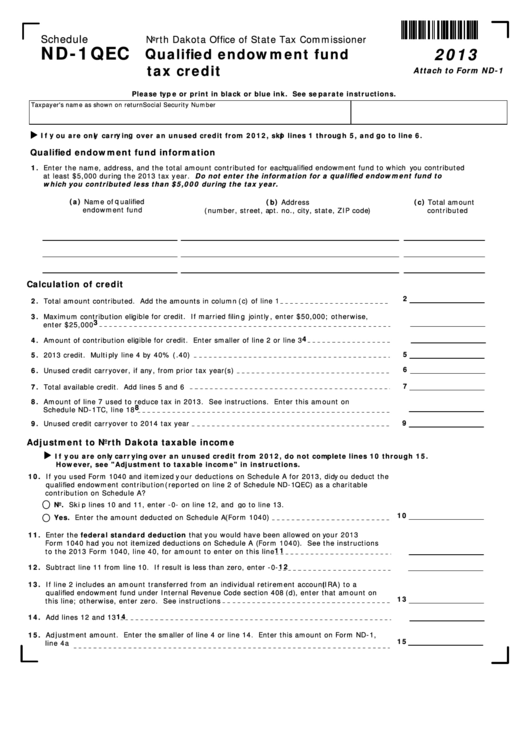

Schedule

North Dakota Office of State Tax Commissioner

ND-1QEC

2013

Qualified endowment fund

tax credit

Attach to Form ND-1

Please type or print in black or blue ink. See separate instructions.

Taxpayer's name as shown on return

Social Security Number

If you are only carrying over an unused credit from 2012, skip lines 1 through 5, and go to line 6.

Qualified endowment fund information

1. Enter the name, address, and the total amount contributed for each qualified endowment fund to which you contributed

at least $5,000 during the 2013 tax year. Do not enter the information for a qualified endowment fund to

which you contributed less than $5,000 during the tax year.

(a) Name of qualified

(b) Address

(c) Total amount

endowment fund

(number, street, apt. no., city, state, ZIP code)

contributed

Calculation of credit

2

2. Total amount contributed. Add the amounts in column (c) of line 1

3. Maximum contribution eligible for credit. If married filing jointly, enter $50,000; otherwise,

3

enter $25,000

4

4. Amount of contribution eligible for credit. Enter smaller of line 2 or line 3

5

5. 2013 credit. Multiply line 4 by 40% (.40)

6

6. Unused credit carryover, if any, from prior tax year(s)

7

7. Total available credit. Add lines 5 and 6

8. Amount of line 7 used to reduce tax in 2013. See instructions. Enter this amount on

8

Schedule ND-1TC, line 18

9

9. Unused credit carryover to 2014 tax year

Adjustment to North Dakota taxable income

If you are only carrying over an unused credit from 2012, do not complete lines 10 through 15.

However, see "Adjustment to taxable income" in instructions.

10. If you used Form 1040 and itemized your deductions on Schedule A for 2013, did you deduct the

qualified endowment contribution (reported on line 2 of Schedule ND-1QEC) as a charitable

contribution on Schedule A?

No. Skip lines 10 and 11, enter -0- on line 12, and go to line 13.

10

Yes. Enter the amount deducted on Schedule A (Form 1040)

11. Enter the federal standard deduction that you would have been allowed on your 2013

Form 1040 had you not itemized deductions on Schedule A (Form 1040). See the instructions

11

to the 2013 Form 1040, line 40, for amount to enter on this line

12

12. Subtract line 11 from line 10. If result is less than zero, enter -0-

13. If line 2 includes an amount transferred from an individual retirement account (IRA) to a

qualified endowment fund under Internal Revenue Code section 408(d), enter that amount on

13

this line; otherwise, enter zero. See instructions

14

14. Add lines 12 and 13

15. Adjustment amount. Enter the smaller of line 4 or line 14. Enter this amount on Form ND-1,

15

line 4a

1

1 2

2