Instructions For Schedule P (Form 540nr) - Alternative Minimum Tax And Credit Limitations - Nonresidents Or Part-Year Residents - 2013

ADVERTISEMENT

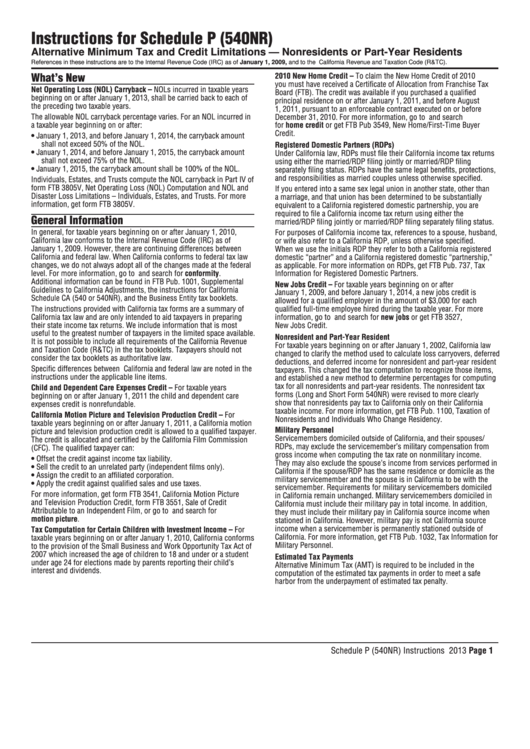

Instructions for Schedule P (540NR)

Alternative Minimum Tax and Credit Limitations — Nonresidents or Part-Year Residents

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

What’s New

2010 New Home Credit – To claim the New Home Credit of 2010

you must have received a Certificate of Allocation from Franchise Tax

Net Operating Loss (NOL) Carryback – NOLs incurred in taxable years

Board (FTB). The credit was available if you purchased a qualified

beginning on or after January 1, 2013, shall be carried back to each of

principal residence on or after January 1, 2011, and before August

the preceding two taxable years.

1, 2011, pursuant to an enforceable contract executed on or before

The allowable NOL carryback percentage varies. For an NOL incurred in

December 31, 2010. For more information, go to ftb.ca.gov and search

a taxable year beginning on or after:

for home credit or get FTB Pub 3549, New Home/First-Time Buyer

Credit.

• January 1, 2013, and before January 1, 2014, the carryback amount

shall not exceed 50% of the NOL.

Registered Domestic Partners (RDPs)

• January 1, 2014, and before January 1, 2015, the carryback amount

Under California law, RDPs must file their California income tax returns

shall not exceed 75% of the NOL.

using either the married/RDP filing jointly or married/RDP filing

• January 1, 2015, the carryback amount shall be 100% of the NOL.

separately filing status. RDPs have the same legal benefits, protections,

and responsibilities as married couples unless otherwise specified.

Individuals, Estates, and Trusts compute the NOL carryback in Part IV of

form FTB 3805V, Net Operating Loss (NOL) Computation and NOL and

If you entered into a same sex legal union in another state, other than

Disaster Loss Limitations – Individuals, Estates, and Trusts. For more

a marriage, and that union has been determined to be substantially

information, get form FTB 3805V.

equivalent to a California registered domestic partnership, you are

required to file a California income tax return using either the

General Information

married/RDP filing jointly or married/RDP filing separately filing status.

In general, for taxable years beginning on or after January 1, 2010,

For purposes of California income tax, references to a spouse, husband,

California law conforms to the Internal Revenue Code (IRC) as of

or wife also refer to a California RDP, unless otherwise specified.

January 1, 2009. However, there are continuing differences between

When we use the initials RDP they refer to both a California registered

California and federal law. When California conforms to federal tax law

domestic “partner” and a California registered domestic “partnership,”

changes, we do not always adopt all of the changes made at the federal

as applicable. For more information on RDPs, get FTB Pub. 737, Tax

level. For more information, go to ftb.ca.gov and search for conformity.

Information for Registered Domestic Partners.

Additional information can be found in FTB Pub. 1001, Supplemental

New Jobs Credit – For taxable years beginning on or after

Guidelines to California Adjustments, the instructions for California

January 1, 2009, and before January 1, 2014, a new jobs credit is

Schedule CA (540 or 540NR), and the Business Entity tax booklets.

allowed for a qualified employer in the amount of $3,000 for each

The instructions provided with California tax forms are a summary of

qualified full-time employee hired during the taxable year. For more

California tax law and are only intended to aid taxpayers in preparing

information, go to ftb.ca.gov and search for new jobs or get FTB 3527,

their state income tax returns. We include information that is most

New Jobs Credit.

useful to the greatest number of taxpayers in the limited space available.

Nonresident and Part-Year Resident

It is not possible to include all requirements of the California Revenue

For taxable years beginning on or after January 1, 2002, California law

and Taxation Code (R&TC) in the tax booklets. Taxpayers should not

changed to clarify the method used to calculate loss carryovers, deferred

consider the tax booklets as authoritative law.

deductions, and deferred income for nonresident and part-year resident

Specific differences between California and federal law are noted in the

taxpayers. This changed the tax computation to recognize those items,

instructions under the applicable line items.

and established a new method to determine percentages for computing

tax for all nonresidents and part-year residents. The nonresident tax

Child and Dependent Care Expenses Credit – For taxable years

forms (Long and Short Form 540NR) were revised to more clearly

beginning on or after January 1, 2011 the child and dependent care

show that nonresidents pay tax to California only on their California

expenses credit is nonrefundable.

taxable income. For more information, get FTB Pub. 1100, Taxation of

California Motion Picture and Television Production Credit – For

Nonresidents and Individuals Who Change Residency.

taxable years beginning on or after January 1, 2011, a California motion

Military Personnel

picture and television production credit is allowed to a qualified taxpayer.

Servicemembers domiciled outside of California, and their spouses/

The credit is allocated and certified by the California Film Commission

RDPs, may exclude the servicemember’s military compensation from

(CFC). The qualified taxpayer can:

gross income when computing the tax rate on nonmilitary income.

• Offset the credit against income tax liability.

They may also exclude the spouse’s income from services performed in

• Sell the credit to an unrelated party (independent films only).

California if the spouse/RDP has the same residence or domicile as the

• Assign the credit to an affiliated corporation.

military servicemember and the spouse is in California to be with the

• Apply the credit against qualified sales and use taxes.

servicemember. Requirements for military servicemembers domiciled

For more information, get form FTB 3541, California Motion Picture

in California remain unchanged. Military servicemembers domiciled in

and Television Production Credit, form FTB 3551, Sale of Credit

California must include their military pay in total income. In addition,

Attributable to an Independent Film, or go to ftb.ca.gov and search for

they must include their military pay in California source income when

motion picture.

stationed in California. However, military pay is not California source

income when a servicemember is permanently stationed outside of

Tax Computation for Certain Children with Investment Income – For

California. For more information, get FTB Pub. 1032, Tax Information for

taxable years beginning on or after January 1, 2010, California conforms

Military Personnel.

to the provision of the Small Business and Work Opportunity Tax Act of

2007 which increased the age of children to 18 and under or a student

Estimated Tax Payments

under age 24 for elections made by parents reporting their child’s

Alternative Minimum Tax (AMT) is required to be included in the

interest and dividends.

computation of the estimated tax payments in order to meet a safe

harbor from the underpayment of estimated tax penalty.

Schedule P (540NR) Instructions 2013 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8