Form Au-215 - Pari-Mutuel Tax Return Of Uncashed Pari-Mutuel Tickets

ADVERTISEMENT

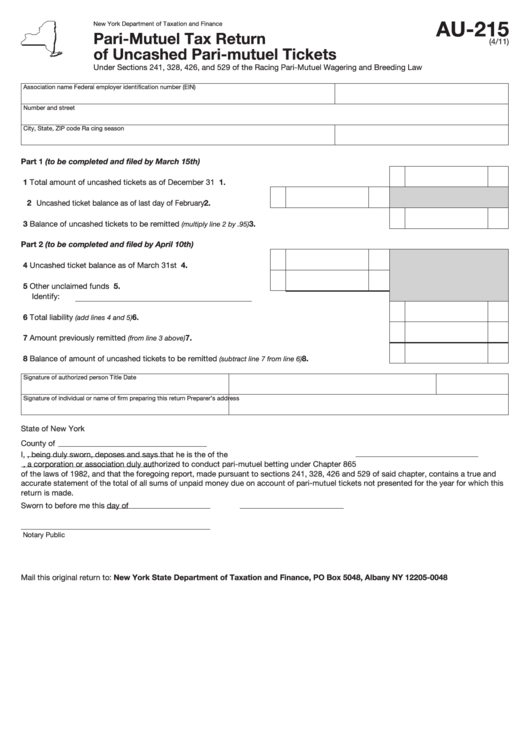

AU-215

New York Department of Taxation and Finance

Pari-Mutuel Tax Return

(4/11)

of Uncashed Pari-mutuel Tickets

Under Sections 241, 328, 426, and 529 of the Racing Pari-Mutuel Wagering and Breeding Law

Association name

Federal employer identification number (EIN)

Number and street

City, State, ZIP code

Ra cing season

Part 1 (to be completed and filed by March 15th)

1 Total amount of uncashed tickets as of December 31 .............................................................................

1.

2 Uncashed ticket balance as of last day of February ............................

2.

3 Balance of uncashed tickets to be remitted

............................................................

3.

(multiply line 2 by .95)

Part 2 (to be completed and filed by April 10th)

4 Uncashed ticket balance as of March 31st ......................................

4.

5 Other unclaimed funds .....................................................................

5.

Identify:

6 Total liability

..................................................................................................................

6.

(add lines 4 and 5)

7 Amount previously remitted

..........................................................................................

7.

(from line 3 above)

8 Balance of amount of uncashed tickets to be remitted

8.

....................................

(subtract line 7 from line 6)

Signature of authorized person

Title

Date

Signature of individual or name of firm preparing this return

Preparer’s address

State of New York

County of

I,

, being duly sworn, deposes and says that he is the

of the

, a corporation or association duly authorized to conduct pari-mutuel betting under Chapter 865

of the laws of 1982, and that the foregoing report, made pursuant to sections 241, 328, 426 and 529 of said chapter, contains a true and

accurate statement of the total of all sums of unpaid money due on account of pari-mutuel tickets not presented for the year for which this

return is made.

Sworn to before me this

day of

Notary Public

Mail this original return to: New York State Department of Taxation and Finance, PO Box 5048, Albany NY 12205-0048

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1