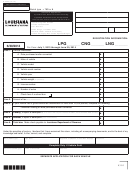

R-5390(I) (12/13)

Act 879 of the 1986 Regular Legislative Session changed the method of collecting the Special Fuels Tax on vehicles which are powered

using liquefied petroleum gas, compressed natural gas, and/or liquefied natural gas.

Compressed natural gas (CNG), liquefied natural gas (LNG), and liquefied petroleum gas (LPG) are subject to Louisiana’s fuel tax when

used to power a motor vehicle licensed or required to be licensed for highway use. The payment of the fuel tax is evidenced by a special

fuel decal. The owners or operators of these vehicles are required to register each vehicle with the Department of Revenue and obtain

a special fuel decal to indicate the payment of applicable fuel tax. The decals are renewed each year the vehicle is in use and are due

annually by July 31. Vehicles acquired, altered, or converted after July 1 must be registered and have been issued a decal.

Instructions

Line 1

You must supply all information requested. A separate form must be completed for each vehicle.

Line 2

Enter $150.00 ($75.00 for a school bus which transports Louisiana students).

In cases where a vehicle was purchased and/or converted after July 31, the tax due shall be as outlined below:

Date purchased or converted

Tax due

August 1 - August 31

$ 137.50

September 1 - September 30

$ 125.00

October 1 - October 31

$ 112.50

November 1 - November 30

$ 100.00

December 1 - December 31

$

87.50

January 1 - January 31

$ 75.00

February 1 - February 28 (29)

$ 62.50

March 1 - March 31

$ 50.00

April 1 - April 30

$

37.50

May 1 - May 31

$ 25.00

June 1 - June 30

$ 12.50

Line 3

You must complete this line if your vehicle has a gross license tax classification of more than 10,000 pounds.

Line 4 PENALTY: If you file late, a delinquent penalty is due. The penalty is 5% for each 30 days or fraction thereof, not to exceed 25%

of the tax due on Line 2.An annual report becomes delinquent on August 1, and a partial year return becomes delinquent 16

days after the purchase of a converted vehicle or after a vehicle has been converted.

Line 5 INTEREST: Calculate interest from the due date to the date paid. Refer to the Tax Interest Rate Schedule (R-1111) for monthly

interest rates that apply. Form R-1111 is available on the Department’s website at

Line 6 TOTAL DUE: Add the amounts shown on Lines 2, 4, and 5. Please make check or money order payable to the Louisiana

Department of Revenue.

8309

1

1 2

2