R-5611 PM(i) (11/13)

General Information

The information on this schedule is required to comply with Louisiana laws relating to the Master Settlement Agreement (“MSA”).

Under Louisiana law (LSA-R.S. 13:5061 et seq. and LSA-R.S. 13:5071 et seq.), information about cigarettes and loose-leaf tobacco

suitable for making cigarettes (“roll-your-own”) reported on the Tobacco Tax Return (Form R-5604) must be itemized on this schedule.

Separate schedules must be completed for Participating Manufacturers and Non-Participating Manufacturers. A current list of cigarette

and roll-your-own tobacco manufacturers, approved for sale in Louisiana, is maintained on the Louisiana Attorney General’s website

or , and may be viewed by clicking on the link entitled “Tobacco Unit” followed by the “Approved

Manufacturers and Brands” link. You must file this schedule even if you report zero amounts. Complete this schedule and attach the original

to your monthly Tobacco Tax Return (Form R-5604) and forward a copy of this schedule to the Department of Justice, Tobacco Section,

P.O. Box 94005, Baton Rouge, LA 70804-9005.

This schedule is to be completed for all cigarettes and Roll-Your-Own (RYO) products manufactured by a Participating Manufacturer

(PM) that were remaining in inventory as of the end of the reporting month for those brands not listed on the state directory as products

approved for sale in the State of Louisiana. This includes cigarettes, whether stamped or unstamped, and RYO possessed or otherwise

located on-hand in the warehouse of the wholesale dealer. This schedule shall be completed only by those Louisiana licensed stamping

agents who hold an exporter license to engage in interstate business or affix tax stamps of another state AND are either domiciled in

Louisiana or have a warehouse or other place of business located in Louisiana.

Definitions

For the purposes of this schedule:

“Importer”

means any person in the United States to whom non-tax paid cigarettes manufactured in a foreign country

are shipped or consigned, any person who removes cigarettes for sale or consumption in the United

States from a customs-bonded manufacturing warehouse, and any person who smuggles or otherwise

unlawfully brings cigarettes into the United States.

“Inventory”

means the cigarettes, whether stamped or unstamped, and RYO acquired, possessed, or located on hand

in the warehouse of the wholesale dealer as of the last day of the month for which the report or schedule is

being completed and does not include cigarettes or RYO purchased or invoiced during the month reported.

“Invoiced”

means an itemized bill for goods SOLD per month, containing individual prices, the total charge, and the

terms of sale.

“Product Country of Origin”

means the country of origin listed on the packaging of the cigarettes or RYO being reported.

“Purchase”

means the total amount of cigarettes acquired per month in any manner, for any consideration and includes

transporting or receiving product in connection with a purchase.

“Sale or sell”

means any transfer, exchange or barter in any manner or by any means for any consideration. The term

includes distributing or shipping product in connection with a sale. References to a sale “in” or “into” a

state refer to the state of the destination point of the product in the sale, without regard to where title was

transferred. References to sale “from” a state refer to the sale of cigarettes that are located in that state to

the destination in question without regard to where title was transferred.

“Manufacturer”

means an entity that directly, and not exclusively through any affiliate:

(a) Manufacturers cigarettes anywhere that the manufacturer intends to be sold in the United States,

including cigarettes intended to be sold in the US through an importer, except if the importer is an

original PM as defined in the MSA.

(b) Is the first purchaser anywhere for resale in the United States of cigarettes manufactured anywhere

that the manufacturer does not intend to be sold in the United States.

(c) Becomes a successor of an entity described in (a) or (b). The term does not include an affiliate of a

manufacturer unless such affiliate itself falls within any of (a), (b), or (c).

Instructions

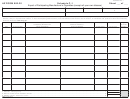

Adjustments to Inventory: Report items not covered by an invoice, which includes, but is not limited to adjustments for returned, lost,

stolen or destroyed product. For each adjustment listed, enter the information requested in the respective columns. Attach an explanation

of any adjustment reported.

Column A – Enter the date the adjustment was made.

Column B – Enter the brand name of the cigarette or RYO.

Column C – Enter the number of cigarette sticks for each brand listed in Column B.

Column D – Enter the number of ounces of RYO for each brand listed in Column B.

Column E – Enter the name and address of the vendor from whom the product in Column B was purchased.

Column F – Provide the name and address of the product manufacturer or the first importer of the product listed in Column B.

Column G – Provide the state where the product is located.

Column H – Provide the country of origin of each product listed in Column B.

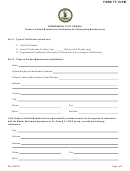

Physical Ending Inventory: Take a physical count of the product on hand at the close of business on the last working day of the reporting

period. For each product in inventory at the close of the calendar month, enter the information requested in the respective columns.

Column A – Enter the brand name of the cigarette or RYO.

Column B – Enter the number of cigarette sticks for each brand listed in Column A.

Column C – Enter the number of ounces of RYO for each brand listed in Column A.

Column D – Enter the name and address of the vendor from whom the product in Column A was purchased.

Column E – Provide the name and address of the product manufacturer or the first importer of the product listed in Column A.

Column F – Provide the state where the product is located.

Column G – Provide the country of origin of each product listed in Column A.

If more than one sheet is needed to report the product, subtotal each sheet, and enter a total on the final page of this schedule.

1

1 2

2