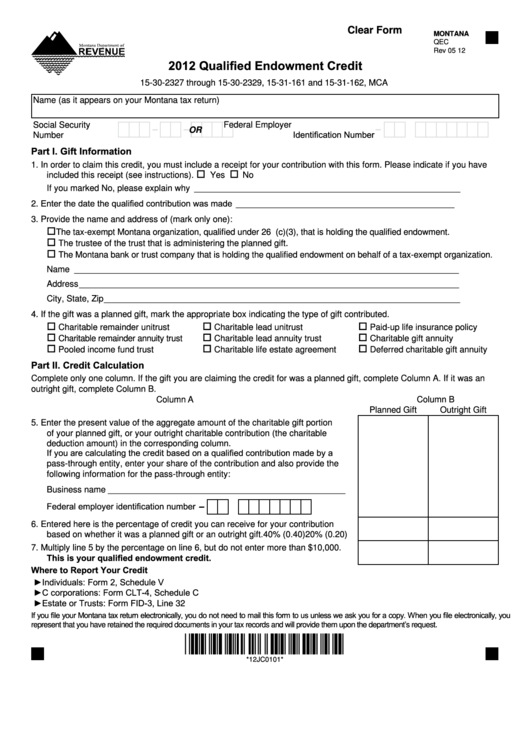

Clear Form

MONTANA

QEC

Rev 05 12

2012 Qualified Endowment Credit

15-30-2327 through 15-30-2329, 15-31-161 and 15-31-162, MCA

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Identification Number

Number

Part I. Gift Information

1. In order to claim this credit, you must include a receipt for your contribution with this form. Please indicate if you have

included this receipt (see instructions).

Yes

No

If you marked No, please explain why ________________________________________________________

2. Enter the date the qualified contribution was made ______________________________________________

3. Provide the name and address of (mark only one):

The tax-exempt Montana organization, qualified under 26 U.S.C. 501(c)(3), that is holding the qualified endowment.

The trustee of the trust that is administering the planned gift.

The Montana bank or trust company that is holding the qualified endowment on behalf of a tax-exempt organization.

Name _________________________________________________________________________________

Address ________________________________________________________________________________

City, State, Zip ___________________________________________________________________________

4. If the gift was a planned gift, mark the appropriate box indicating the type of gift contributed.

Charitable remainder unitrust

Charitable lead unitrust

Paid-up life insurance policy

Charitable remainder annuity trust

Charitable lead annuity trust

Charitable gift annuity

Pooled income fund trust

Charitable life estate agreement

Deferred charitable gift annuity

Part II. Credit Calculation

Complete only one column. If the gift you are claiming the credit for was a planned gift, complete Column A. If it was an

outright gift, complete Column B.

Column A

Column B

Planned Gift

Outright Gift

5. Enter the present value of the aggregate amount of the charitable gift portion

of your planned gift, or your outright charitable contribution (the charitable

deduction amount) in the corresponding column.

If you are calculating the credit based on a qualified contribution made by a

pass-through entity, enter your share of the contribution and also provide the

following information for the pass-through entity:

Business name __________________________________________________

Federal employer identification number

-

6. Entered here is the percentage of credit you can receive for your contribution

based on whether it was a planned gift or an outright gift.

40% (0.40)

20% (0.20)

7. Multiply line 5 by the percentage on line 6, but do not enter more than $10,000.

This is your qualified endowment credit.

Where to Report Your Credit

►Individuals: Form 2, Schedule V

►C corporations: Form CLT-4, Schedule C

►Estate or Trusts: Form FID-3, Line 32

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12JC0101*

*12JC0101*

1

1 2

2 3

3 4

4