Form E-589c - Affidavit To Exempt Contractors From The Additional 1% Dare County Sales And Use Tax

ADVERTISEMENT

4

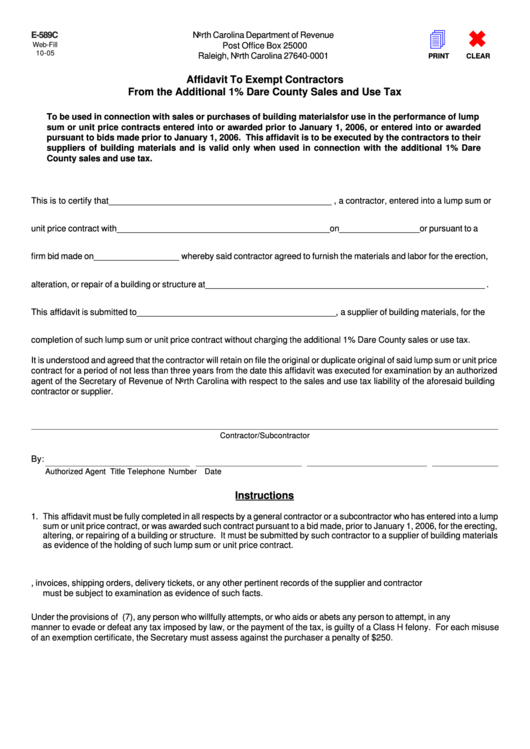

E-589C

North Carolina Department of Revenue

Web-Fill

Post Office Box 25000

10-05

Raleigh, North Carolina 27640-0001

PRINT

CLEAR

Affidavit To Exempt Contractors

From the Additional 1% Dare County Sales and Use Tax

To be used in connection with sales or purchases of building materials for use in the performance of lump

sum or unit price contracts entered into or awarded prior to January 1, 2006, or entered into or awarded

pursuant to bids made prior to January 1, 2006. This affidavit is to be executed by the contractors to their

suppliers of building materials and is valid only when used in connection with the additional 1% Dare

County sales and use tax.

This is to certify that _______________________________________________ , a contractor, entered into a lump sum or

unit price contract with _____________________________________________ on _________________ or pursuant to a

firm bid made on __________________ whereby said contractor agreed to furnish the materials and labor for the erection,

alteration, or repair of a building or structure at ___________________________________________________________ .

This affidavit is submitted to __________________________________________ , a supplier of building materials, for the

completion of such lump sum or unit price contract without charging the additional 1% Dare County sales or use tax.

It is understood and agreed that the contractor will retain on file the original or duplicate original of said lump sum or unit price

contract for a period of not less than three years from the date this affidavit was executed for examination by an authorized

agent of the Secretary of Revenue of North Carolina with respect to the sales and use tax liability of the aforesaid building

contractor or supplier.

Contractor/Subcontractor

By:

Authorized Agent

Title

Telephone Number

Date

Instructions

1. This affidavit must be fully completed in all respects by a general contractor or a subcontractor who has entered into a lump

sum or unit price contract, or was awarded such contract pursuant to a bid made, prior to January 1, 2006, for the erecting,

altering, or repairing of a building or structure. It must be submitted by such contractor to a supplier of building materials

as evidence of the holding of such lump sum or unit price contract.

2. The building materials supplier and the contractor should retain the affidavit on file for a period of not less than three years.

3. The contractor must retain on file the original or duplicate original of the lump sum or unit price contract.

4. Purchase orders, invoices, shipping orders, delivery tickets, or any other pertinent records of the supplier and contractor

must be subject to examination as evidence of such facts.

Under the provisions of G.S. 105-236(7), any person who willfully attempts, or who aids or abets any person to attempt, in any

manner to evade or defeat any tax imposed by law, or the payment of the tax, is guilty of a Class H felony. For each misuse

of an exemption certificate, the Secretary must assess against the purchaser a penalty of $250.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1