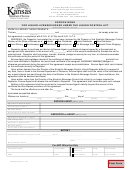

Form Mt-132 - Manifest Form For Liquors Page 2

ADVERTISEMENT

MT-132 (9/93) (back)

General Information

3. You must provide a copy of the manifest to the registered

distributor, if any, shown in item 6.

You must complete Form MT-132 if you transport more than 90

liters of liquors into, through or within New York State.

The transporter and all others who are required to get a copy of

A properly prepared Form MT-132 must be in the possession of

the manifest must keep a copy for three years from the end of the

month when the liquor was delivered.

the operator/driver of the transportation equipment.

You must make all the appropriate manifest entries before you

transport liquors in New York State and prepare a separate

Delivery or Manifest Changes

manifest for each owner, importer or business for whom you carry

If, at any time before completion of the last delivery, there is a

liquors, even if the liquors are part of the same load.

change to any manifest information, you must immediately amend

the manifest to reflect the change.

You may reproduce (photocopy, computer-generate, etc.)

Form MT-132 and/or incorporate it into other documents that you

use, provided the reproduction is in the same format and general

size as the official Form MT-132.

Part I — Transporter Section (items 1-5)

Complete Part I before transporting liquors in New York State. The

manifest numbers for item 1 must be consecutively numbered.

You may be allowed to use a manifest in a different format after

receiving written permission from the Tax Department. Submit your

request for use of a different format to:

NYS TAX DEPARTMENT

Part II — Distributor Section (items 6-8)

DEPUTY COMMISSIONER

Complete Part II before transporting liquors in New York State. If

OFFICE OF TAX ENFORCEMENT

the liquors are being transported through the state and will not be

BUILDING 9, ROOM 211

used, distributed, stored or sold in the state, or if the liquors are

W A HARRIMAN CAMPUS

not being imported into New York State, enter N/A in items 6, 7

ALBANY NY 12227

and 8. Enter N/A in items 6, 7 and 8 if you purchased liquors at

retail for your personal use and consumption.

General Instructions

The distributor is the person that imports or causes the liquors to

These are the steps that you must take when you transport liquors

be imported into the state for sale or use in the state, or the

in New York State. Keep the manifest on the transportation

person who produces, distills, manufactures, compounds, mixes or

equipment until the last delivery covered by the manifest is made.

ferments any liquors in the state, (except (a) a person who

manufactures, mixes or compounds liquors, the ingredients of

If the information for two items will be the same, enter the

which consist only of alcoholic beverages on which the alcoholic

information in one item and enter same as item X in the other

beverage taxes have been paid or (b) a person who mixes or

item to identify the item where the information is entered.

compounds liquors, on which the alcoholic beverage taxes have

been paid, with nonalcoholic ingredients for sale and immediate

1. Before transporting liquors in the state, complete items 1-19.

consumption on the premises), or the person that purchases

Do not leave any item blank. If an item is not applicable, enter

warehouse receipts for liquors stored in a warehouse in the state

N/A .

and causes liquors to be removed from the warehouse.

Part I (items 1, 2, 3, 4, and 5) and Part III (items 9, 10, 11,

12 and 13) are usually applicable and must contain the

appropriate information. If not applicable, enter N/A in the

Part III – Loading Section (items 9-13)

item.

Complete Part III before transporting liquors in New York State.

Part II (items 6, 7 and 8) is applicable only to the importation

of liquors into the state for use, distribution, storage or sale in

the state. Enter N/A in each of these items if the liquors are

not being imported into the state for use, distribution, storage

Part IV — Delivery Section (items 14-18)

or sale in the state.

Complete Part IV (a) before transporting liquors in New York

State. For a second delivery, also complete Part IV (b). Correct

You must use either Part IV (items 14-18) or Part V (item 19).

item 17, if necessary, when the delivery is complete. You may

Part V must be used in conjunction with invoices, and the

reproduce multiple Part IVs if you have more than two deliveries.

invoices must contain all of the information contained in Part

You may use Part V instead of Part IV. Enter N/A in items 14-18 if

IV.

you use Part V.

Part IV (a) and Part IV (b) may be used for up to two

deliveries of liquors. If more than two deliveries of liquors are

to be made, you may complete Part V instead of Part IV, or

you may reproduce Part IV.

Part V — Multiple Delivery Section (item 19)

Complete Part V before transporting liquors in New York State.

2. Upon delivery of any liquors, you must verify the date and

Correct the date and time of delivery, if necessary, on the invoice

time of delivery in item 17 of the appropriate Part IV or the

when the delivery is complete. The invoices that you list in item 19

corresponding item on the invoice if Part V is used. Correct

must contain all of the information contained in Part IV. Enter N/A

item 17 if necessary.

if you use Part IV.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2