Form L-2101 - Motor Fuel Terminal Operator Annual Return Page 5

ADVERTISEMENT

STATE OF SOUTH CAROLINA

MOTOR FUEL TERMINAL OPERATOR'S YEARLY RETURN

INSTRUCTIONS FOR L-2101

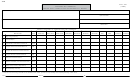

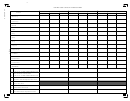

GAIN/LOSS CALCULATION SHEET

DUE DATE - FEBRUARY 26TH - A return must be filed for each calendar year on or before February 26 of the following

year. A return should be filed even if no user fee is due.

GENERAL INFORMATION

This return will determine if any user fee and/or fees are due for excessive loss of a product. The net product lost may not

exceed 1/2 of 1 percent of the total gallons removed from the terminal across the rack.

COMPLETING THE PRODUCT SCHEDULES

The information to complete the yearly return should be found on the monthly terminal return. For each product type list

the loss or gain and total gallons removed for each month. Total each column of the schedule before beginning

calculations. Complete the calculations for each product type. Use Line 7 of the monthly return to determine the loss or

gain for each month. Use Lines 4 and 5 of the monthly return to determine the removals for each month.

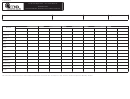

COMPLETING THE REPORT

LINE 1

1/2 OF 1% OF NET GALLONS REMOVED - Calculate Line 1 by multiplying the TOTAL GALLONS REMOVED

by .005.

LINE 2

NET GALLONS GAINED PLUS 1/2 OF 1% OF NET GALLONS REMOVED - Calculate Line 2 by adding the

NET GALLONS GAINED and Line 1.

LINE 3

USER FEE GALLONS LOST - To determine the number of gallons for Line 3, compare Line 2 to the NET

GALLONS LOST. If the NET GALLONS LOST is less than Line 2, enter zero on Line 3 and zero on Lines 4

through 7. If the NET GALLONS LOST is greater than Line 2, enter the difference on Line 3 and complete

Lines 4 through 7.

LINE 4

USER FEE DUE - Calculate Line 4 by multiplying Line 3 by $0.16. User Fee due will be calculated for

Gasoline/Gasohol and Undyed Diesel/Biodiesel products only.

LINE 5

INSPECTION FEES DUE - Calculate Line 5 by multiplying Line 3 by $0.0025. Inspection fees are calculated on

all product types.

LINE 6

ENVIRONMENTAL IMPACT FEE DUE - Calculate Line 6 by multiplying Line 3 by $0.0050. Environmental fees

are calculated on all product types

LINE 7

5% OF NET GALLONS REMOVED - Calculate Line 7 by multiplying the TOTAL GALLONS REMOVED by .05.

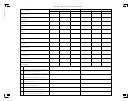

USER FEE, INSPECTION AND ENVIROMENTAL FEES, PENALTY AND INTEREST

LINES 8 AND 12

USER FEE DUE - Enter the amount from Line 4 under Gasoline/Gasohol on Line 8. Enter the amount from

Line 4 under Undyed Diesel/Biodiesel on Line 12.

LINES 16 AND 20

INSPECTION AND ENVIROMENTAL FEES DUE - Add the amounts from Line 5 for each product type and

enter the total on Line 16. Add the amounts from Line 6 for each product type and enter the total on Line 20.

PENALTY ON USER FEE - LINES 9 AND 13

Penalty in the amount of 100 percent of the user fee due should be added if the NET

GALLONS LOST exceed Line 7 (5% of the total gallons removed). This penalty

applies to Gasoline/Gasohol and Undyed Diesel/Biodiesel products and also applies

even though the yearly return is filed by the due date. This penalty is in addition to

any other penalty that may apply under Chapter 54.

44581015

L-2101 I

(Rev. 10/15/14) 4458

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

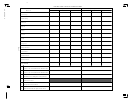

1

1 2

2 3

3 4

4 5

5 6

6