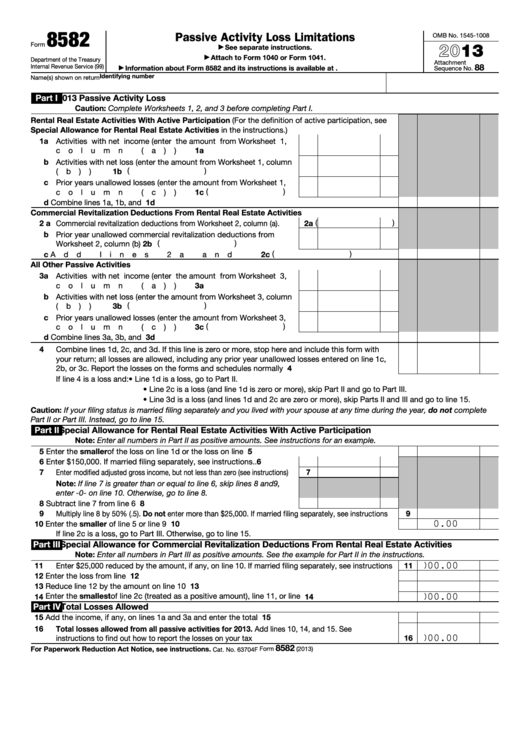

8582

Passive Activity Loss Limitations

OMB No. 1545-1008

2013

Form

See separate instructions.

▶

Attach to Form 1040 or Form 1041.

▶

Department of the Treasury

Attachment

88

Internal Revenue Service (99)

Information about Form 8582 and its instructions is available at

Sequence No.

▶

Identifying number

Name(s) shown on return

Part I

2013 Passive Activity Loss

Caution: Complete Worksheets 1, 2, and 3 before completing Part I.

Rental Real Estate Activities With Active Participation (For the definition of active participation, see

Special Allowance for Rental Real Estate Activities in the instructions.)

1 a Activities with net income (enter the amount from Worksheet 1,

1a

column (a))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Activities with net loss (enter the amount from Worksheet 1, column

1b (

)

(b)) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Prior years unallowed losses (enter the amount from Worksheet 1,

1c (

)

column (c))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d Combine lines 1a, 1b, and 1c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1d

Commercial Revitalization Deductions From Rental Real Estate Activities

2a (

)

2 a Commercial revitalization deductions from Worksheet 2, column (a) .

b Prior year unallowed commercial revitalization deductions from

2b (

)

Worksheet 2, column (b) .

.

.

.

.

.

.

.

.

.

.

.

.

.

2c (

)

c Add lines 2a and 2b

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

All Other Passive Activities

3 a Activities with net income (enter the amount from Worksheet 3,

3a

column (a))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Activities with net loss (enter the amount from Worksheet 3, column

3b (

)

(b)) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Prior years unallowed losses (enter the amount from Worksheet 3,

3c (

)

column (c))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d Combine lines 3a, 3b, and 3c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3d

4

Combine lines 1d, 2c, and 3d. If this line is zero or more, stop here and include this form with

your return; all losses are allowed, including any prior year unallowed losses entered on line 1c,

2b, or 3c. Report the losses on the forms and schedules normally used

.

.

.

.

.

.

.

.

4

If line 4 is a loss and:

• Line 1d is a loss, go to Part II.

• Line 2c is a loss (and line 1d is zero or more), skip Part II and go to Part III.

• Line 3d is a loss (and lines 1d and 2c are zero or more), skip Parts II and III and go to line 15.

Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete

Part II or Part III. Instead, go to line 15.

Part II

Special Allowance for Rental Real Estate Activities With Active Participation

Note: Enter all numbers in Part II as positive amounts. See instructions for an example.

5

Enter the smaller of the loss on line 1d or the loss on line 4

.

.

.

.

.

.

.

.

.

.

.

.

5

6

6

Enter $150,000. If married filing separately, see instructions .

.

7

Enter modified adjusted gross income, but not less than zero (see instructions)

7

Note: If line 7 is greater than or equal to line 6, skip lines 8 and 9,

enter -0- on line 10. Otherwise, go to line 8.

8

Subtract line 7 from line 6

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Multiply line 8 by 50% (.5). Do not enter more than $25,000. If married filing separately, see instructions

9

10

Enter the smaller of line 5 or line 9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

0.00

If line 2c is a loss, go to Part III. Otherwise, go to line 15.

Part III

Special Allowance for Commercial Revitalization Deductions From Rental Real Estate Activities

Note: Enter all numbers in Part III as positive amounts. See the example for Part II in the instructions.

11

11

Enter $25,000 reduced by the amount, if any, on line 10. If married filing separately, see instructions

-25,000.00

12

Enter the loss from line 4 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

Reduce line 12 by the amount on line 10

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Enter the smallest of line 2c (treated as a positive amount), line 11, or line 13

.

.

.

.

.

.

14

14

-25,000.00

Part IV

Total Losses Allowed

15

Add the income, if any, on lines 1a and 3a and enter the total .

.

.

.

.

.

.

.

.

.

.

.

15

16

Total losses allowed from all passive activities for 2013. Add lines 10, 14, and 15. See

16

instructions to find out how to report the losses on your tax return .

.

.

.

.

.

.

.

.

.

.

-25,000.00

8582

For Paperwork Reduction Act Notice, see instructions.

Form

(2013)

Cat. No. 63704F

1

1 2

2 3

3