Form 41a720nol-Cf (10-12) - Kentucky Nol Carryforward Schedule

ADVERTISEMENT

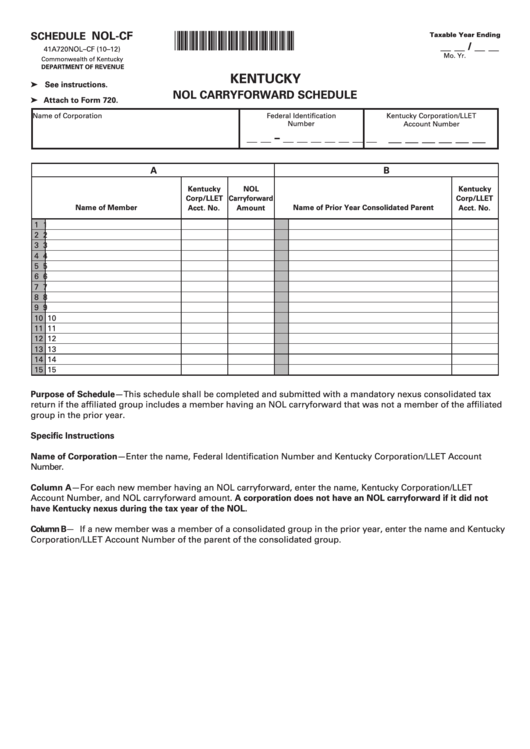

NOL-CF

SCHEDULE

*1200020281*

Taxable Year Ending

__ __ / __ __

41A720NOL–CF (10–12)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KENTUCKY

➤ See instructions.

NOL CARRYFORWARD SCHEDULE

➤ Attach to Form 720.

Name of Corporation

Federal Identification

Kentucky Corporation/LLET

Number

Account Number

__ __ __ __ __ __

__ __ – __ __ __ __ __ __ __

A

B

Kentucky

NOL

Kentucky

Corp/LLET

Carryforward

Corp/LLET

Name of Member

Name of Prior Year Consolidated Parent

Acct. No.

Amount

Acct. No.

1

1

2

2

3

3

4

4

5

5

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

15

15

Purpose of Schedule—This schedule shall be completed and submitted with a mandatory nexus consolidated tax

return if the affiliated group includes a member having an NOL carryforward that was not a member of the affiliated

group in the prior year.

Specific Instructions

Name of Corporation—Enter the name, Federal Identification Number and Kentucky Corporation/LLET Account

Number.

Column A—For each new member having an NOL carryforward, enter the name, Kentucky Corporation/LLET

Account Number, and NOL carryforward amount. A corporation does not have an NOL carryforward if it did not

have Kentucky nexus during the tax year of the NOL.

Column B—If a new member was a member of a consolidated group in the prior year, enter the name and Kentucky

Corporation/LLET Account Number of the parent of the consolidated group.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1