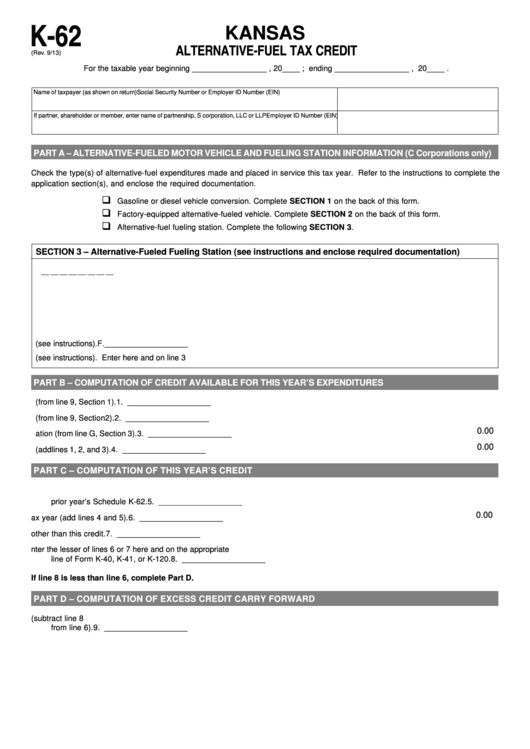

K-62

KANSAS

ALTERNATIVE-FUEL TAX CREDIT

(Rev. 9/13)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – ALTERNATIVE-FUELED MOTOR VEHICLE AND FUELING STATION INFORMATION (C Corporations only)

Check the type(s) of alternative-fuel expenditures made and placed in service this tax year. Refer to the instructions to complete the

application section(s), and enclose the required documentation.

Gasoline or diesel vehicle conversion. Complete SECTION 1 on the back of this form.

Factory-equipped alternative-fueled vehicle. Complete SECTION 2 on the back of this form.

Alternative-fuel fueling station. Complete the following SECTION 3.

SECTION 3 – Alternative-Fueled Fueling Station (see instructions and enclose required documentation)

A. Date facility placed in service.

A.

__ __ __ __ __ __ __ __

B. Expenditures for compression equipment.

B. ___________________

C. Expenditures for storage tanks/receptacles.

C. ___________________

D. Expenditures for delivery property.

D. ___________________

E. Total qualified alternative-fuel fueling station expenditures.

E. ___________________

F.

Amount of fueling station expenditures available for the credit (see instructions).

F. ___________________

G.

Amount of credit (see instructions). Enter here and on line 3 below.

G. ___________________

PART B – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S EXPENDITURES

1. Amount of credit for gasoline or diesel vehicle conversion (from line 9, Section 1).

1. ___________________

2. Amount of credit for factory-equipped vehicle (from line 9, Section 2).

2. ___________________

0.00

3. Amount of credit for alternative-fueled fueling station (from line G, Section 3).

3. ___________________

0.00

4. Total credit available (add lines 1, 2, and 3).

4. ___________________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

5.

Amount of carry forward available on this return. Enter the amount of carry forward from the

prior year’s Schedule K-62.

5. ___________________

0.00

6.

Total credit available this tax year (add lines 4 and 5).

6. ___________________

7.

Your tax liability for this tax year after all credits other than this credit.

7. ___________________

8.

Alternative fuel credit for this tax year. Enter the lesser of lines 6 or 7 here and on the appropriate

line of Form K-40, K-41, or K-120.

8. ___________________

If line 8 is less than line 6, complete Part D.

PART D – COMPUTATION OF EXCESS CREDIT CARRY FORWARD

9.

Amount of carry forward available to report on your Schedule K-62 for next year (subtract line 8

from line 6).

9. ___________________

1

1 2

2 3

3 4

4