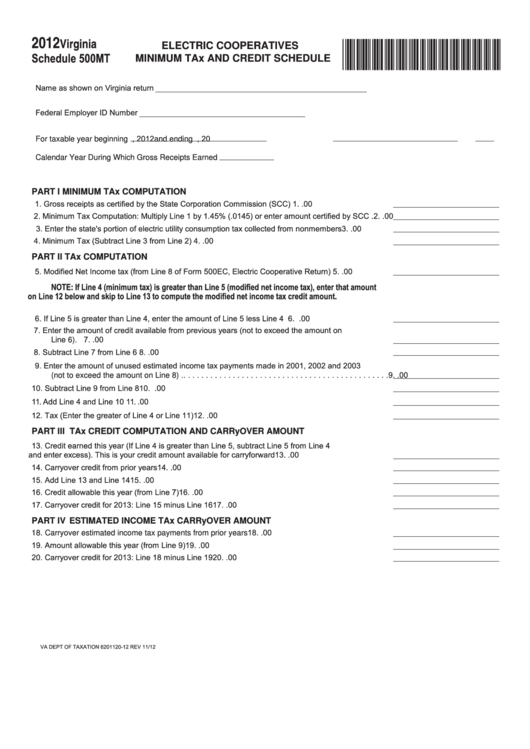

2012

Virginia

*VAECMT112888*

ELECTRIC COOPERATIVES

Schedule 500MT

MINIMUM TAx AND CREDIT SCHEDULE

Name as shown on Virginia return

Federal Employer ID Number

, 2012 and ending

, 20

For taxable year beginning

Calendar Year During Which Gross Receipts Earned

PART I

MINIMUM TAx COMPUTATION

1. Gross receipts as certified by the State Corporation Commission (SCC) . . . . . . . . . . . . . . . . . . . 1.

.00

2. Minimum Tax Computation: Multiply Line 1 by 1.45% (.0145) or enter amount certified by SCC . 2.

.00

3. Enter the state's portion of electric utility consumption tax collected from nonmembers . . . . . . . . 3.

.00

4. Minimum Tax (Subtract Line 3 from Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

.00

PART II TAx COMPUTATION

5. Modified Net Income tax (from Line 8 of Form 500EC, Electric Cooperative Return) . . . . . . . . . . 5.

.00

NOTE: If Line 4 (minimum tax) is greater than Line 5 (modified net income tax), enter that amount

on Line 12 below and skip to Line 13 to compute the modified net income tax credit amount.

6. If Line 5 is greater than Line 4, enter the amount of Line 5 less Line 4 . . . . . . . . . . . . . . . . . . . . 6.

.00

7. Enter the amount of credit available from previous years (not to exceed the amount on

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

.00

Line 6).

8. Subtract Line 7 from Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

.00

9. Enter the amount of unused estimated income tax payments made in 2001, 2002 and 2003

(not to exceed the amount on Line 8) .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

.00

10. Subtract Line 9 from Line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

.00

11. Add Line 4 and Line 10

11.

.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Tax (Enter the greater of Line 4 or Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

.00

PART III TAx CREDIT COMPUTATION AND CARRyOVER AMOUNT

13. Credit earned this year (If Line 4 is greater than Line 5, subtract Line 5 from Line 4

and enter excess). This is your credit amount available for carryforward . . . . . . . . . . . . . . . . . . 13.

.00

14. Carryover credit from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

.00

15. Add Line 13 and Line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

.00

16. Credit allowable this year (from Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

.00

17. Carryover credit for 2013: Line 15 minus Line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

.00

PART IV ESTIMATED INCOME TAx CARRyOVER AMOUNT

18. Carryover estimated income tax payments from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

.00

19. Amount allowable this year (from Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

.00

20. Carryover credit for 2013: Line 18 minus Line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

.00

VA DEPT OF TAXATION

6201120-12 REV 11/12

1

1