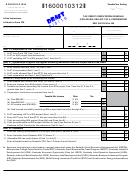

Schedule Ieia (Form 41a720-S50) - Tax Credit Computation Schedule (For An Ieia Project Of A Corporation) Page 2

ADVERTISEMENT

Page 2

41A720-S50 (10-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS—SCHEDULE IEIA

The IEIA tax credit is applied against the corporation income tax imposed by KRS 141.040 and/or the limited liability

entity tax (LLET) imposed by KRS 141.0401. The amount of tax credit against each tax can be different; however, for

tracking purposes, the larger amount of credit used against either tax is the amount that is used for the tax year.

PURPOSE OF SCHEDULE—This schedule is used by a

Part III—Limitation

corporation which has entered into a financing agreement

Calculate IEIA tax credit based on the corporation’s tax

or a tax incentive agreement for an Incentives for Energy

liability, tax liability attributable to IEIA project and credit

Independence Act (IEIA) project to determine the credit

limitation from Schedule IEIA-T. Enter credit on Schedule

allowed against the Kentucky corporation income tax

TCS, Part I, Column E and Column F.

and LLET attributable to the project in accordance with

KRS 141.421.

A corporation with more than one economic development

projec t must separately compute the tax credit

derived from each project. Complete an applicable tax

GENERAL INSTRUCTIONS

computation schedule (Schedule KREDA, Schedule

KIDA, Schedule KEOZ, Schedule KJRA, Schedule

KIRA, Schedule KJDA, Schedule KBI, Schedule KRA or

Part I—Computation of LLET Excluding IEIA Project

Schedule IEIA) for each project. A corporation approved

for the Skills Training Investment Credit Act (STICA) or

Metropolitan College Consortium Tax Credit (MCC) must

Line 2—Using Schedule LLET, create a new Schedule

attach a copy of the certification(s) from the Bluegrass

LLET to compute the LLET of the IEIA project using

State Skills Corporation. A corporation approved for the

only the Kentucky gross receipts and Kentucky gross

Kentucky Small Business Investment Credit Program

profits of the project. Enter “IEIA” at the top center of

(KSBIC) must attach a copy of the certification from the

the Schedule LLET and attach it to the tax return.

Kentucky Economic Development Finance Authority.

Alternative Methods—In accordance with KRS 141.421(7),

Part II—Computation of Taxable Net Income Excluding

if the approved company can show that the nature of the

Net Income from IEIA Project and IEIA Tax Credit

operations and activities of the approved company are

such that it is not practical to use separate accounting

to determine net income, Kentucky gross receipts or

Section B

Kentucky gross profits from the facility at which the

project is located, the approved company shall determine

net income, Kentucky gross receipts or Kentucky gross

Line 2—Enter net income from IEIA project. If the

profits attributable to the project using an alternative

corporation’s only operation in Kentucky is the IEIA

method approved by the Department of Revenue. Thus,

project, the amount entered on Line 1 must be entered

if any method other than separate accounting is used,

on Line 2.

a copy of the letter from the Department of Revenue

approving the alternative method must be attached to

See form for computation.

this schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2