Form Sc 1120u - Public Utility Tax Return Page 6

ADVERTISEMENT

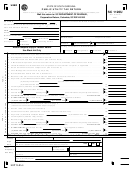

SC1120U

Page 6

SCHEDULE K

COMPUTATION OF LICENSE FEE - PUBLIC UTILITIES

1. Fair Market Value of Property Owned and Used in the Conduct of Business in SC as determined by the

1.

SC Department of Revenue for Property Tax purposes for the Preceding tax year. . . . . . . . . . . . . . . . . . . . . .

$

2. License Fee: Fair Market Value Component (Line 1 x .001) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

(A) TOTAL SYSTEM

(B) IN SOUTH CAROLINA

Operating Revenue (List below):

$

3. Total Operating Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

3.

Other Receipts (List below):

4. Total Other Receipts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

4.

5. Total Gross Receipts (Add Lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

5.

6. License Fee: Gross Receipts Component (Line 5, Column B x .003) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Total License Fee (Add lines 2 and 6, but not less than $25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Section 12-20-105 Credit (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Amount Due (Line 7 minus line 8, but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . .BALANCE DUE

9.

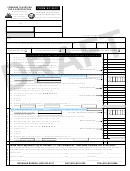

S.C. Code Section 12-20-100 imposes a license fee on every express, street railway, navigation, waterworks, power, light, gas,

telegraph, and telephone company equal to 0.1% (rounded up) of the fair market value of property owned and used within South

Carolina in the conduct of business as determined by the Department of Revenue for property tax purposes for the preceding tax year,

plus 0.3% (rounded up) of gross receipts derived from services rendered from regulated business within South Carolina during the

preceding tax year. The minimum license fee is $25.00.

SC Regulation 117-1075.1 provides: "Gross receipts, as used in Section 12-20-100, include all receipts from operations within the

State, and also other profit and loss items with a local situs. Intangible income from intangibles used in the conduct of the business

within this State is included in gross receipts."

30976021

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9