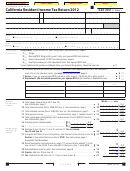

Your name:

Your SSN or ITIN:

Whole

only

dollars

Taxable

Income and

9 Total wages (federal Form W-2, box 16).

Credits

See instructions, page 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

,

.

00

10 Total interest income (Form 1099-INT, box 1). See instructions, page 7 . . . . . . .

10

,

00

.

11 Total dividend income (Form 1099-DIV, box 1a). See instructions, page 7. . . . . .

11

,

00

.

12 Total pension income

. See instructions, page 7. Taxable amount. .

12

,

.

00

13 Total capital gains distributions from mutual funds (Form 1099-DIV, box 2a).

Enclose, but do

See instructions, page 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

,

00

.

not staple, any

payment.

14 Unemployment compensation . . . . . . . . . . . 14

,

00

.

15

15

,

00

U.S. social security or railroad retirement benefits..

.

16 Add line 9, line 10, line 11, line 12, and line 13. Do not include

line 14 and line 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

,

00

.

17 Using the 2EZ Table for your filing status, enter the tax for the amount on line 16. 17

,

00

.

Caution: If you check the box on line 6, STOP. See instructions, page 8,

Dependent Tax Worksheet.

18 Senior exemption: See instructions, page 8. If you are 65 and entered 1 in the

18

box on line 7, enter $106. If you entered 2 in the box on line 7, enter $212 . . .

00

.

19 Nonrefundable renter’s credit. See instructions, page 8 . . . . . . . . . . . . . . . . . . .

19

.

00

20 Credits. Add line 18 and line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

.

21 Tax. Subtract line 20 from line 17. If zero or less, enter -0- . . . . . . . . . . . . . . . . .

21

,

.

00

Overpaid

22 Total tax withheld (federal Form W-2, box 17

Tax/

or Form 1099-R, box 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

,

00

.

Tax Due

.

23 Overpaid tax. If line 22 is more than line 21, subtract line 21 from line 22. . . . . .

23

,

00

.

24 Tax due. If line 22 is less than line 21, subtract line 22 from line 21.

See instructions, page 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

,

00

.

This space reserved for 2D barcode

Side 2

Form 540 2EZ

2013

C1

3112133

1

1 2

2 3

3 4

4