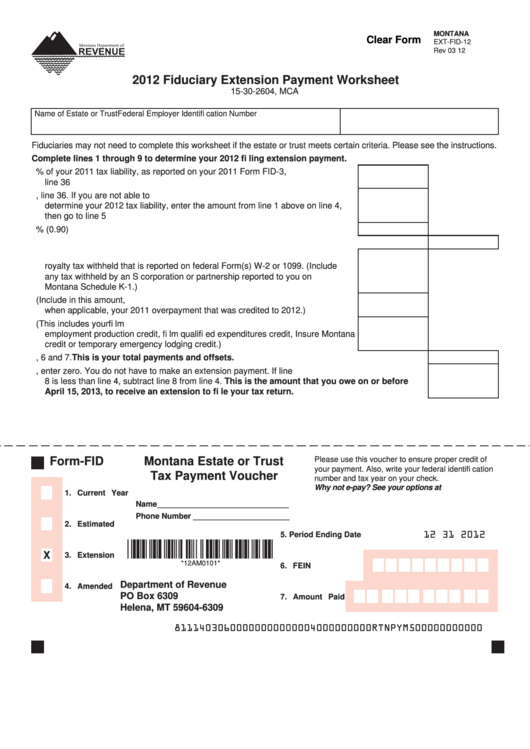

MONTANA

Clear Form

EXT-FID-12

Rev 03 12

2012 Fiduciary Extension Payment Worksheet

15-30-2604, MCA

Name of Estate or Trust

Federal Employer Identifi cation Number

Fiduciaries may not need to complete this worksheet if the estate or trust meets certain criteria. Please see the instructions.

Complete lines 1 through 9 to determine your 2012 fi ling extension payment.

1. Enter 100% of your 2011 tax liability, as reported on your 2011 Form FID-3,

line 36 ................................................................................................................... 1.

2. Enter the tax liability from your 2012 Form FID-3, line 36. If you are not able to

determine your 2012 tax liability, enter the amount from line 1 above on line 4,

then go to line 5 .................................................................................................... 2.

3. Multiply line 2 by 90% (0.90) ................................................................................ 3.

4. Enter the smaller of line 1 or line 3 .................................................................................................... 4.

5. Enter the amount of any 2012 Montana income tax withheld and/or mineral

royalty tax withheld that is reported on federal Form(s) W-2 or 1099. (Include

any tax withheld by an S corporation or partnership reported to you on

Montana Schedule K-1.) ....................................................................................... 5.

6. Enter the amount of your 2012 estimated tax payments. (Include in this amount,

when applicable, your 2011 overpayment that was credited to 2012.) ................. 6.

7. Enter the amount of your 2012 refundable credits. (This includes your fi lm

employment production credit, fi lm qualifi ed expenditures credit, Insure Montana

credit or temporary emergency lodging credit.) .................................................... 7.

8. Add lines 5, 6 and 7. This is your total payments and offsets. ..................................................... 8.

9. If line 8 is greater than line 4, enter zero. You do not have to make an extension payment. If line

8 is less than line 4, subtract line 8 from line 4. This is the amount that you owe on or before

April 15, 2013, to receive an extension to fi le your tax return..................................................... 9.

Form-FID

Montana Estate or Trust

Please use this voucher to ensure proper credit of

your payment. Also, write your federal identifi cation

Tax Payment Voucher

number and tax year on your check.

Why not e-pay? See your options at revenue.mt.gov.

1. Current Year

Name ______________________________

Phone Number ______________________

2. Estimated

12 31 2012

5. Period Ending Date

*12AM0101*

X

3. Extension

*12AM0101*

6. FEIN

Department of Revenue

4. Amended

PO Box 6309

7. Amount Paid

Helena, MT 59604-6309

81114030600000000000004000000000RTNPYM500000000000

1

1 2

2