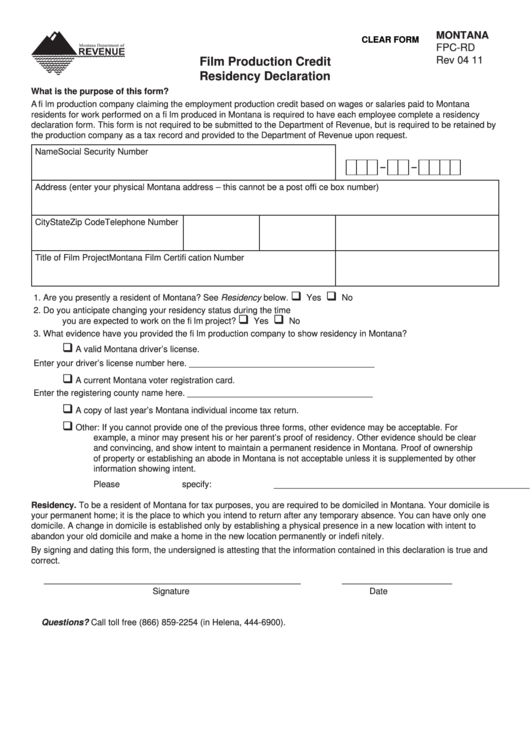

MONTANA

CLEAR FORM

FPC-RD

Rev 04 11

Film Production Credit

Residency Declaration

What is the purpose of this form?

A fi lm production company claiming the employment production credit based on wages or salaries paid to Montana

residents for work performed on a fi lm produced in Montana is required to have each employee complete a residency

declaration form. This form is not required to be submitted to the Department of Revenue, but is required to be retained by

the production company as a tax record and provided to the Department of Revenue upon request.

Name

Social Security Number

-

-

Address (enter your physical Montana address – this cannot be a post offi ce box number)

City

State

Zip Code

Telephone Number

Title of Film Project

Montana Film Certifi cation Number

1.

Are you presently a resident of Montana? See Residency below.

Yes

No

2.

Do you anticipate changing your residency status during the time

you are expected to work on the fi lm project?

Yes

No

3.

What evidence have you provided the fi lm production company to show residency in Montana?

A valid Montana driver’s license.

Enter your driver’s license number here. _______________________________________

A current Montana voter registration card.

Enter the registering county name here. _______________________________________

A copy of last year’s Montana individual income tax return.

Other: If you cannot provide one of the previous three forms, other evidence may be acceptable. For

example, a minor may present his or her parent’s proof of residency. Other evidence should be clear

and convincing, and show intent to maintain a permanent residence in Montana. Proof of ownership

of property or establishing an abode in Montana is not acceptable unless it is supplemented by other

information showing intent.

Please specify: __________________________________________________________

Residency. To be a resident of Montana for tax purposes, you are required to be domiciled in Montana. Your domicile is

your permanent home; it is the place to which you intend to return after any temporary absence. You can have only one

domicile. A change in domicile is established only by establishing a physical presence in a new location with intent to

abandon your old domicile and make a home in the new location permanently or indefi nitely.

By signing and dating this form, the undersigned is attesting that the information contained in this declaration is true and

correct.

_________________________________________________

_____________________

Signature

Date

Questions? Call toll free (866) 859-2254 (in Helena, 444-6900).

1

1