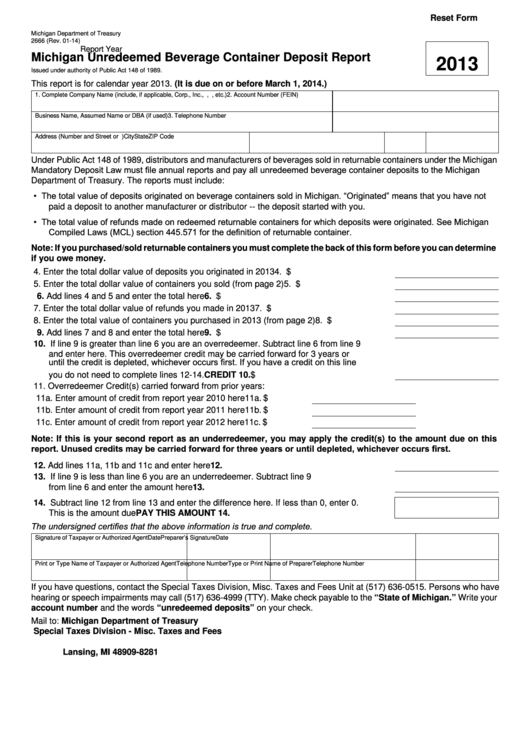

Reset Form

Michigan Department of Treasury

2666 (Rev. 01-14)

Report Year

Michigan Unredeemed Beverage Container Deposit Report

2013

Issued under authority of Public Act 148 of 1989.

This report is for calendar year 2013. (It is due on or before March 1, 2014.)

1. Complete Company Name (include, if applicable, Corp., Inc., P.C., L.L.C., etc.)

2. Account Number (FEIN)

Business Name, Assumed Name or DBA (if used)

3. Telephone Number

Address (Number and Street or P.O. Box)

City

State

ZIP Code

Under Public Act 148 of 1989, distributors and manufacturers of beverages sold in returnable containers under the Michigan

Mandatory Deposit Law must file annual reports and pay all unredeemed beverage container deposits to the Michigan

Department of Treasury. The reports must include:

• The total value of deposits originated on beverage containers sold in Michigan. “Originated” means that you have not

paid a deposit to another manufacturer or distributor -- the deposit started with you.

• The total value of refunds made on redeemed returnable containers for which deposits were originated. See Michigan

Compiled Laws (MCL) section 445.571 for the definition of returnable container.

Note: If you purchased/sold returnable containers you must complete the back of this form before you can determine

if you owe money.

4. Enter the total dollar value of deposits you originated in 2013 ..........................................4. $

5. Enter the total dollar value of containers you sold (from page 2) ......................................5. $

6. Add lines 4 and 5 and enter the total here ........................................................................6. $

7. Enter the total dollar value of refunds you made in 2013 ..................................................7. $

8. Enter the total value of containers you purchased in 2013 (from page 2) .........................8. $

9. Add lines 7 and 8 and enter the total here ........................................................................9. $

10. If line 9 is greater than line 6 you are an overredeemer. Subtract line 6 from line 9

and enter here. This overredeemer credit may be carried forward for 3 years or

until the credit is depleted, whichever occurs first. If you have a credit on this line

you do not need to complete lines 12-14. ........................................................ CREDIT 10. $

11. Overredeemer Credit(s) carried forward from prior years:

11a. Enter amount of credit from report year 2010 here ..............11a. $

11b. Enter amount of credit from report year 2011 here ...............11b. $

11c. Enter amount of credit from report year 2012 here ...............11c. $

Note: If this is your second report as an underredeemer, you may apply the credit(s) to the amount due on this

report. Unused credits may be carried forward for three years or until depleted, whichever occurs first.

12. Add lines 11a, 11b and 11c and enter here .....................................................................12.

13. If line 9 is less than line 6 you are an underredeemer. Subtract line 9

from line 6 and enter the amount here ............................................................................13.

14. Subtract line 12 from line 13 and enter the difference here. If less than 0, enter 0.

This is the amount due .................................................................. PAY THIS AMOUNT 14.

The undersigned certifies that the above information is true and complete.

Signature of Taxpayer or Authorized Agent

Date

Preparer’s Signature

Date

Print or Type Name of Taxpayer or Authorized Agent

Telephone Number

Type or Print Name of Preparer

Telephone Number

If you have questions, contact the Special Taxes Division, Misc. Taxes and Fees Unit at (517) 636-0515. Persons who have

hearing or speech impairments may call (517) 636-4999 (TTY). Make check payable to the “State of Michigan.” Write your

account number and the words “unredeemed deposits” on your check.

Mail to: Michigan Department of Treasury

Special Taxes Division - Misc. Taxes and Fees

P.O. Box 30781

Lansing, MI 48909-8281

1

1 2

2