2014 Form M11T Instructions

(continued)

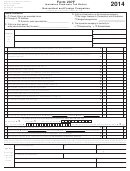

Worksheet: Additional Charge for Underpaying Estimated Tax for 2014

1 Enter 80 percent of your total annual tax liability from line 5 of your 2014 Form M11T.

If your tax liability was $500 or less, you do not owe an additional charge. . . . . . . . . . . . . . . . . . . . . . . 1

2 Enter the amount from line 5 of your 2013 Form M11T. If you were not required to file

a 2013 return, you do not owe an additional charge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Due Dates

March 15

June 15

Sept. 15

Dec. 15

3 Enter one-fourth of step 1 or step 2 (whichever is less)

in each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Amounts paid on or before the due date for each period. Include

credits applied, such as prior year’s overpayment . . . . . . . . . . . . . . . 4

5 Overpayment of previous installment (see worksheet instructions) . 5

6 Add steps 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Underpayment (or overpayment). Subtract step 6 from step 3 . . . . . 7

8 Date underpayment is paid or March 1, 2015, whichever is earlier . . . .8

9 Number of days from the due date to the date on step 8 . . . . . . . . . 9

10 Additional charge (step 9 ÷ 365 × interest (see below) × step 7) . . 10

11 TOTAL. Add amounts in each column on step 10.

Enter the result here and on Form M11T, line 8a . . . . . . . . . . . . . . . 11

If step 11 is zero, keep this worksheet for your records. If it is more than zero, attach a copy of the worksheet to your Form M11T.

Interest: 2014 = .03; 2015 = .03

Worksheet Instructions

Step 5

from the estimated payment’s due date to

Credit the excess of any overpayment for

the date the second payment is made.

a period on step 5 of the next payment

Payments of estimated tax are applied

period.

against any underpayments of required

Also, the second estimated payment will

estimated payments in the order that the

then be underpaid by $100 (assuming that

Step 10

estimated payments were due.

the second payment is $200) until sufficient

If there is no underpayment on step 7, enter

repayments are received to eliminate the

For example, if your first estimated payment

“none” on step 10 for that period.

underpayment.

is underpaid by $100 and you deposit $200

for your second estimated payment, $100 of

If more than one payment has been made

your second payment is applied to the first

for a required estimated payment, attach a

estimated payment. The additional charge

separate computation for each payment.

for the first estimated payment is computed

3

1

1 2

2 3

3 4

4