Application For Sales And Use Tax Exemption For Nonprofit Organizations

ADVERTISEMENT

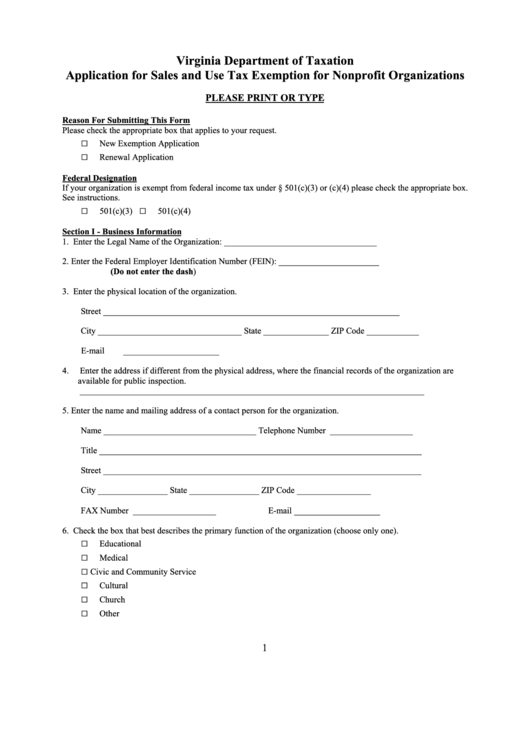

Virginia Department of Taxation

Application for Sales and Use Tax Exemption for Nonprofit Organizations

PLEASE PRINT OR TYPE

Reason For Submitting This Form

Please check the appropriate box that applies to your request.

□

New Exemption Application

□

Renewal Application

Federal Designation

If your organization is exempt from federal income tax under § 501(c)(3) or (c)(4) please check the appropriate box.

See instructions.

□

□

501(c)(3)

501(c)(4)

Section I - Business Information

1.

Enter the Legal Name of the Organization: ___________________________________

2.

Enter the Federal Employer Identification Number (FEIN): _______________________

(Do not enter the dash)

3.

Enter the physical location of the organization.

Street ____________________________________________________________________

City _________________________________ State _______________ ZIP Code ____________

E-mail ______________________

4.

Enter the address if different from the physical address, where the financial records of the organization are

available for public inspection.

_______________________________________________________________________________

5.

Enter the name and mailing address of a contact person for the organization.

Name ___________________________________

Telephone Number ___________________

Title __________________________________________________________________________

Street _________________________________________________________________________

City ________________ State ________________ ZIP Code _________________

__________________

FAX Number ___________________

E-mail

6.

Check the box that best describes the primary function of the organization (choose only one).

□

Educational

□

Medical

□

Civic and Community Service

□

Cultural

□

Church

□

Other

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3