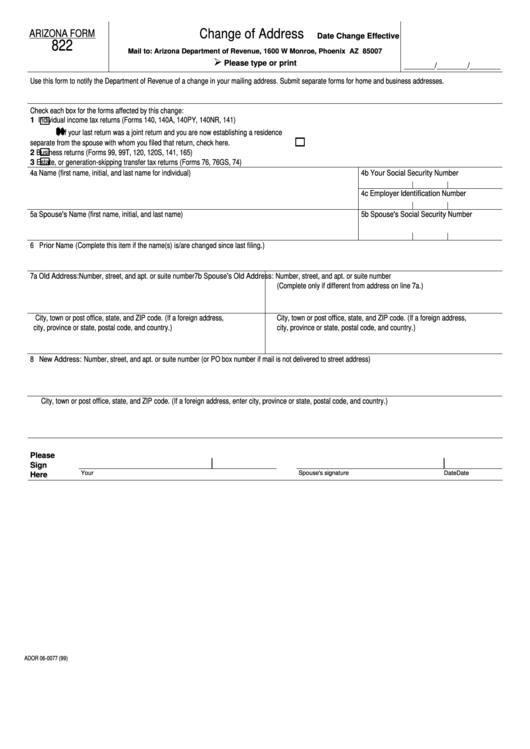

Arizona Form 822 - Change Of Address

ADVERTISEMENT

Change of Address

ARIZONA FORM

Date Change Effective

822

Mail to: Arizona Department of Revenue, 1600 W Monroe, Phoenix AZ 85007

Please type or print

_______/_______/_______

Use this form to notify the Department of Revenue of a change in your mailing address. Submit separate forms for home and business addresses.

Check each box for the forms affected by this change:

Individual income tax returns (Forms 140, 140A, 140PY, 140NR, 141)

1

If your last return was a joint return and you are now establishing a residence

separate from the spouse with whom you filed that return, check here. .....................

Business returns (Forms 99, 99T, 120, 120S, 141, 165)

2

Estate, or generation-skipping transfer tax returns (Forms 76, 76GS, 74)

3

4a Name (first name, initial, and last name for individual)

4b Your Social Security Number

4c Employer Identification Number

5b Spouse's Social Security Number

5a Spouse's Name (first name, initial, and last name)

6 Prior Name (Complete this item if the name(s) is/are changed since last filing.)

7a Old Address: Number, street, and apt. or suite number

7b Spouse's Old Address: Number, street, and apt. or suite number

(Complete only if different from address on line 7a.)

City, town or post office, state, and ZIP code. (If a foreign address,

City, town or post office, state, and ZIP code. (If a foreign address,

city, province or state, postal code, and country.)

city, province or state, postal code, and country.)

8 New Address: Number, street, and apt. or suite number (or PO box number if mail is not delivered to street address)

City, town or post office, state, and ZIP code. (If a foreign address, enter city, province or state, postal code, and country.)

Please

Sign

Your

Date

Spouse's signature

Date

Here

ADOR 06-0077 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1