Form Pt-401 - Application For Exemption

ADVERTISEMENT

1350

1350

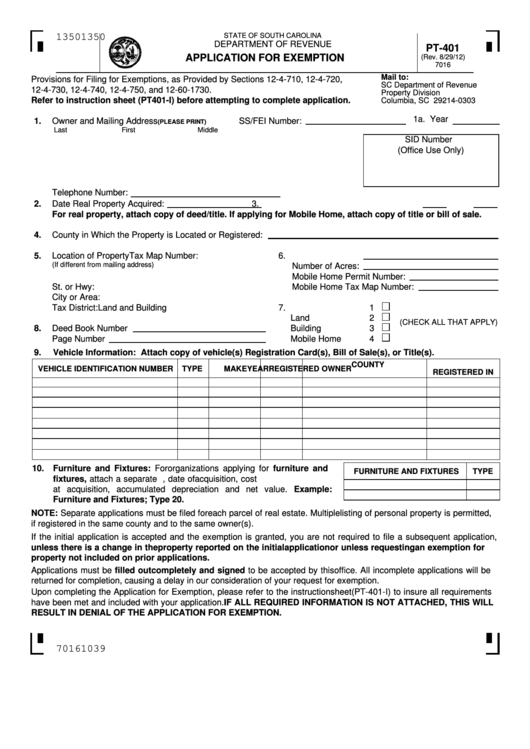

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

PT-401

APPLICATION FOR EXEMPTION

(Rev. 8/29/12)

7016

Mail to:

Provisions for Filing for Exemptions, as Provided by Sections 12-4-710, 12-4-720,

SC Department of Revenue

12-4-730, 12-4-740, 12-4-750, and 12-60-1730.

Property Division

Refer to instruction sheet (PT401-I) before attempting to complete application.

Columbia, SC 29214-0303

1a. Year

1.

Owner and Mailing Address

SS/FEI Number:

(PLEASE PRINT)

Last

First

Middle

SID Number

(Office Use Only)

Telephone Number:

2.

Date Real Property Acquired:

3. S.C. Code Section 12-37-220 A

or B

For real property, attach copy of deed/title. If applying for Mobile Home, attach copy of title or bill of sale.

4.

County in Which the Property is Located or Registered:

5.

Location of Property

6.

Tax Map Number:

(If different from mailing address)

Number of Acres:

Mobile Home Permit Number:

St. or Hwy:

Mobile Home Tax Map Number:

City or Area:

Tax District:

7.

Land and Building

1

Land

2

(CHECK ALL THAT APPLY)

8.

Deed Book Number

Building

3

Page Number

Mobile Home

4

9.

Vehicle Information: Attach copy of vehicle(s) Registration Card(s), Bill of Sale(s), or Title(s).

COUNTY

VEHICLE IDENTIFICATION NUMBER

TYPE

MAKE

YEAR

REGISTERED OWNER

REGISTERED IN

10.

Furniture and Fixtures: For organizations applying for furniture and

FURNITURE AND FIXTURES

TYPE

fixtures, attach a separate sheet. Identify item, date of acquisition, cost

at acquisition, accumulated depreciation and net value. Example:

Furniture and Fixtures; Type 20.

NOTE: Separate applications must be filed for each parcel of real estate. Multiple listing of personal property is permitted,

if registered in the same county and to the same owner(s).

If the initial application is accepted and the exemption is granted, you are not required to file a subsequent application,

unless there is a change in the property reported on the initial application or unless requesting an exemption for

property not included on prior applications.

Applications must be filled out completely and signed to be accepted by this office. All incomplete applications will be

returned for completion, causing a delay in our consideration of your request for exemption.

Upon completing the Application for Exemption, please refer to the instruction sheet (PT-401-I) to insure all requirements

have been met and included with your application. IF ALL REQUIRED INFORMATION IS NOT ATTACHED, THIS WILL

RESULT IN DENIAL OF THE APPLICATION FOR EXEMPTION.

70161039

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2