California Form 3538 - Payment For Automatic Extension For Lps, Llps, And Remics - 2013

ADVERTISEMENT

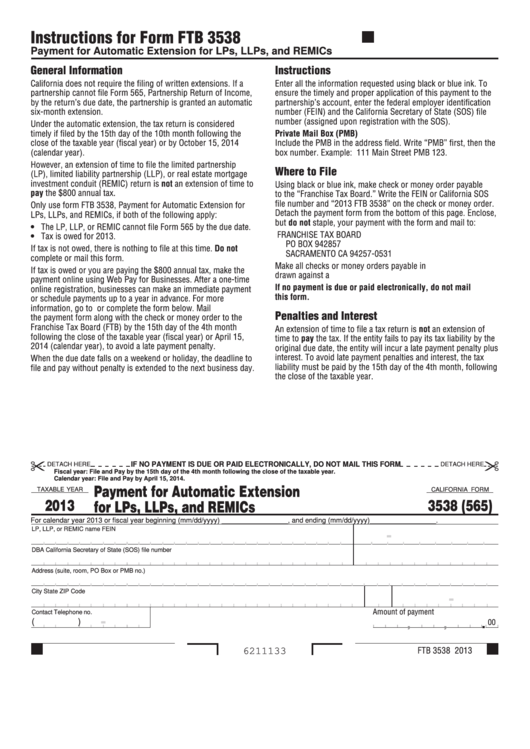

Instructions for Form FTB 3538

Payment for Automatic Extension for LPs, LLPs, and REMICs

General Information

Instructions

California does not require the filing of written extensions. If a

Enter all the information requested using black or blue ink. To

partnership cannot file Form 565, Partnership Return of Income,

ensure the timely and proper application of this payment to the

by the return’s due date, the partnership is granted an automatic

partnership’s account, enter the federal employer identification

six-month extension.

number (FEIN) and the California Secretary of State (SOS) file

number (assigned upon registration with the SOS).

Under the automatic extension, the tax return is considered

timely if filed by the 15th day of the 10th month following the

Private Mail Box (PMB)

close of the taxable year (fiscal year) or by October 15, 2014

Include the PMB in the address field. Write “PMB” first, then the

(calendar year).

box number. Example: 111 Main Street PMB 123.

However, an extension of time to file the limited partnership

Where to File

(LP), limited liability partnership (LLP), or real estate mortgage

investment conduit (REMIC) return is not an extension of time to

Using black or blue ink, make check or money order payable

pay the $800 annual tax.

to the “Franchise Tax Board.” Write the FEIN or California SOS

file number and “2013 FTB 3538” on the check or money order.

Only use form FTB 3538, Payment for Automatic Extension for

Detach the payment form from the bottom of this page. Enclose,

LPs, LLPs, and REMICs, if both of the following apply:

but do not staple, your payment with the form and mail to:

• The LP, LLP, or REMIC cannot file Form 565 by the due date.

FRANCHISE TAX BOARD

• Tax is owed for 2013.

PO BOX 942857

If tax is not owed, there is nothing to file at this time. Do not

SACRAMENTO CA 94257-0531

complete or mail this form.

Make all checks or money orders payable in U.S. dollars and

If tax is owed or you are paying the $800 annual tax, make the

drawn against a U.S. financial institution.

payment online using Web Pay for Businesses. After a one-time

If no payment is due or paid electronically, do not mail

online registration, businesses can make an immediate payment

this form.

or schedule payments up to a year in advance. For more

information, go to ftb.ca.gov or complete the form below. Mail

Penalties and Interest

the payment form along with the check or money order to the

Franchise Tax Board (FTB) by the 15th day of the 4th month

An extension of time to file a tax return is not an extension of

following the close of the taxable year (fiscal year) or April 15,

time to pay the tax. If the entity fails to pay its tax liability by the

2014 (calendar year), to avoid a late payment penalty.

original due date, the entity will incur a late payment penalty plus

interest. To avoid late payment penalties and interest, the tax

When the due date falls on a weekend or holiday, the deadline to

liability must be paid by the 15th day of the 4th month, following

file and pay without penalty is extended to the next business day.

the close of the taxable year.

IF NO PAYMENT IS DUE OR PAID ELECTRONICALLY, DO NOT MAIL THIS FORM

DETACH HERE

DETACH HERE

Fiscal year: File and Pay by the 15th day of the 4th month following the close of the taxable year.

Calendar year: File and Pay by April 15, 2014.

Payment for Automatic Extension

TAXABLE YEAR

CALIFORNIA FORM

2013

3538 (565)

for LPs, LLPs, and REMICs

For calendar year 2013 or fiscal year beginning (mm/dd/yyyy) _________________, and ending (mm/dd/yyyy)_________________.

LP, LLP, or REMIC name

FEIN

-

DBA

California Secretary of State (SOS) file number

Address (suite, room, PO Box or PMB no.)

City

State

ZIP Code

-

Amount of payment

Contact Telephone no.

-

00

(

)

.

,

,

FTB 3538 2013

6211133

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1