Form Ab-131 - Wisconsin Liquor Tax Multiple Schedule - 2013 Page 2

ADVERTISEMENT

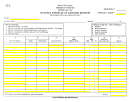

Tax-Paid Credits – Schedule 4

Untaxed Sales – Schedule 5

Itemize all sales of untaxed products shipped during the month into Wisconsin where the

Itemize all tax-paid products found to be short shipped, lost, or broken prior to your

receipt of the tax-paid merchandise from a supplier. Also report documented breakage

liquor taxes, if applicable, are the responsibility of the Wisconsin permittee. Examples

taking place on your premises, and merchandise discovered damaged after its receipt.

of untaxed sales include sales of:

1. Bulk spirits to rectifiers.

Enter total tax-paid credits on line 20 of Form AB-130.

2. Alcohol to industrial and medicinal alcohol permittees.

3. Bulk wine to bottlers, rectifiers, and wineries.

SALES SCHEDULES

Use a single line for each invoice.

4. Wine to industrial wine permittees.

5. Spirits, cider, or wine that will be received in Wisconsin through U.S. Customs

Sales are reportable in the month that actual physical movement of the merchandise

takes place from a wholesaler’s (shipper’s) premise.

and the Wisconsin permittee is designated as the “importer of record.”

The person you are shipping untaxed merchandise to in Wisconsin must have the

Untaxed Sales – Schedule 5

proper permit to purchase merchandise tax-free.

Itemize all sales of untaxed products made during the month to Wisconsin permittees

or shipped out-of-state. Persons receiving untaxed merchandise in Wisconsin must

Do not enter these totals in Section 1 on your Form AB-130 because that section only

have the appropriate permit to purchase merchandise tax-free.

applies to in-state (Wisconsin based) permittees.

In-State Wisconsin Wholesalers Sales to Sacramental Wine Permittees – If you sell

Tax-Paid Sales – Schedule 6

sacramental wine to sacramental wine permittees you are entitled to a refund of the

Itemize all sales of tax-paid products sold to Wisconsin wholesalers for which you are

Wisconsin wine tax you paid on the merchandise. To obtain a refund of the tax you

responsible for paying the Wisconsin distilled spirits, apple cider, and wine taxes. Sales

paid, itemize these sales on your monthly return. The refund will be calculated on your

include all sample products entering Wisconsin via Wisconsin distributors, picked up

monthly return.

at your location by your salespersons and taken to Wisconsin, or sales of sacramental

wine to Wisconsin wholesalers.

Enter total untaxed out-of-state shipments on line 6 of Form AB-130. The total untaxed

Wisconsin sales should be entered on line 7 of Form AB-130.

Enter the totals on line 19 of Form AB-130.

Tax-Paid Sales – Schedule 6

RECORDS

Itemize all sales of tax-paid products whether sold to Wisconsin wholesalers, Wisconsin

Keep a complete copy of your return and all records used in preparing the return for at

retailers, or shipped out-of-state.

least four years. The records must be kept at the permit location for the first two years

in a place and manner easily accessible for review by department representatives.

Credit for Sales of Tax-Paid Merchandise to Out-of-State Customers – If you ship tax-

paid distilled spirits, cider, and/or wine out-of-state you are entitled to a refund of the

Wisconsin beverage tax you paid on the merchandise. To obtain a refund of the tax

ASSISTANCE

you paid, itemize these sales on your monthly return. The refund will be calculated on

You can access the department’s website 24 hours a day, 7 days a week, at

your monthly return.

revenue.wi.gov. From this website you can:

• Access My Tax Account (MTA)

Enter total out-of-state shipments on line 18 of Form AB-130.

• Complete electronic fill-in forms

Total Wisconsin sales should be entered on line 19 of Form AB-130.

• Download forms, schedules, instructions, and publications

• View answers to commonly asked questions

• E-mail us for assistance

SPECIFIC INSTRUCTIONS FOR OUT-OF-STATE PERMITTEES

SALES SCHEDULES

Use a single line for each invoice.

Physical Address

Mailing Address

2135 Rimrock Road

Excise Tax Unit

Report only sales made to permittees in Wisconsin. Sales are reportable in the month

Madison WI 53713

Wisconsin Department of Revenue

that actual physical movement of the merchandise takes place from a shipper’s premise.

PO Box 8900

Phone: (608) 266-6701

Madison WI 53708-8900

Enter the customer’s Wisconsin permit number under U.S. Customs Entry Number or

FAX

(608) 261-7049

Address of Wisconsin Wholesaler.

excise@revenue.wi.gov

E-mail:

AB-131 (R. 12-13)

- 2 -

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3