Form 3725 - California Assets Transferred From Corporation To Insurance Company - 2014

ADVERTISEMENT

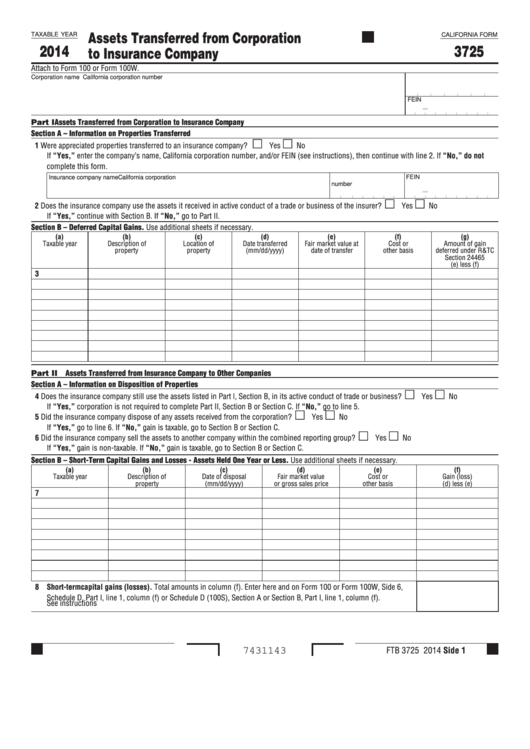

Assets Transferred from Corporation

TAXABLE YEAR

CALIFORNIA FORM

2014

3725

to Insurance Company

Attach to Form 100 or Form 100W .

Corporation name

California corporation number

FEIN

Part I Assets Transferred from Corporation to Insurance Company

Section A – Information on Properties Transferred

1 Were appreciated properties transferred to an insurance company? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes,” enter the company’s name, California corporation number, and/or FEIN (see instructions), then continue with line 2 . If “No,” do not

complete this form .

Insurance company name

California corporation

FEIN

number

2 Does the insurance company use the assets it received in active conduct of a trade or business of the insurer? . . . . . . . . . . . . .

Yes

No

If “Yes,” continue with Section B . If “No,” go to Part II .

Section B – Deferred Capital Gains. Use additional sheets if necessary .

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Taxable year

Description of

Location of

Date transferred

Fair market value at

Cost or

Amount of gain

property

property

(mm/dd/yyyy)

date of transfer

other basis

deferred under R&TC

Section 24465

(e) less (f)

3

Part II Assets Transferred from Insurance Company to Other Companies

Section A – Information on Disposition of Properties

4 Does the insurance company still use the assets listed in Part l, Section B, in its active conduct of trade or business? . . . . . . . .

Yes

No

If “Yes,” corporation is not required to complete Part II, Section B or Section C . If “No,” go to line 5 .

5 Did the insurance company dispose of any assets received from the corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes,” go to line 6 . If “No,” gain is taxable, go to Section B or Section C .

6 Did the insurance company sell the assets to another company within the combined reporting group? . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes,” gain is non-taxable . If “No,” gain is taxable, go to Section B or Section C .

Section B – Short-Term Capital Gains and Losses - Assets Held One Year or Less. Use additional sheets if necessary .

(a)

(b)

(c)

(d)

(e)

(f)

Taxable year

Description of

Date of disposal

Fair market value

Cost or

Gain (loss)

property

(mm/dd/yyyy)

or gross sales price

other basis

(d) less (e)

7

8 Short-term capital gains (losses). Total amounts in column (f) . Enter here and on Form 100 or Form 100W, Side 6,

Schedule D, Part I, line 1, column (f) or Schedule D (100S), Section A or Section B, Part I, line 1, column (f) .

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FTB 3725 2014 Side 1

7431143

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2