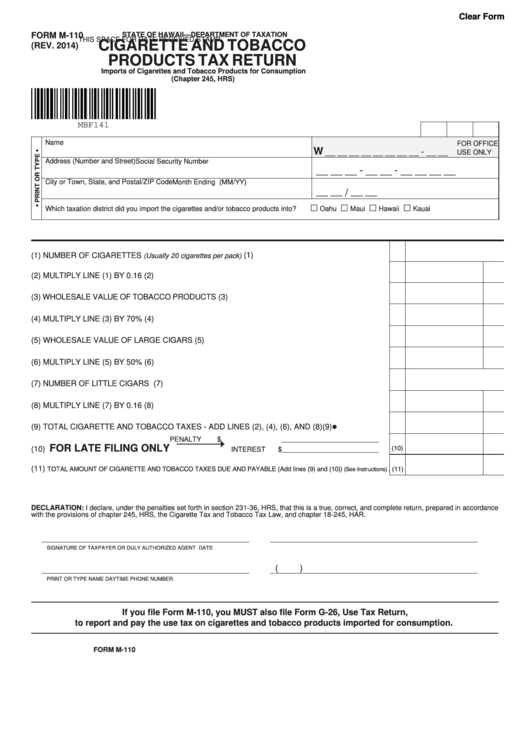

Clear Form

FORM M-110

STATE OF HAWAII—DEPARTMENT OF TAXATION

THIS SPACE FOR DATE RECEIVED STAMP

CIGARETTE AND TOBACCO

(REV. 2014)

PRODUCTS TAX RETURN

Imports of Cigarettes and Tobacco Products for Consumption

(Chapter 245, HRS)

MBF141

Name

FOR OFFICE

W

__ __ __ __ __ __ __ __ - __ __

USE ONLY

Address (Number and Street)

Social Security Number

__ __ __ - __ __ - __ __ __ __

City or Town, State, and Postal/ZIP Code

Month Ending (MM/YY)

__ __ / __ __

Which taxation district did you import the cigarettes and/or tobacco products into?

Oahu

Maui

Hawaii

Kauai

.................................................................. (1)

(1) NUMBER OF CIGARETTES

(Usually 20 cigarettes per pack)

(2) MULTIPLY LINE (1) BY 0.16 ................................................................................................................ (2)

(3) WHOLESALE VALUE OF TOBACCO PRODUCTS ............................................................................. (3)

(4) MULTIPLY LINE (3) BY 70% ................................................................................................................ (4)

(5) WHOLESALE VALUE OF LARGE CIGARS ......................................................................................... (5)

(6) MULTIPLY LINE (5) BY 50% ................................................................................................................ (6)

(7) NUMBER OF LITTLE CIGARS ........................................................................................................... (7)

(8) MULTIPLY LINE (7) BY 0.16 ................................................................................................................ (8)

(9) TOTAL CIGARETTE AND TOBACCO TAXES - ADD LINES (2), (4), (6), AND (8) .............................. (9)

PENALTY

$

(10)

FOR LATE FILING ONLY

(10)

INTEREST

$

(11) TOTAL AMOUNT OF CIGARETTE AND TOBACCO TAXES DUE AND PAYABLE (Add lines (9) and (10))

.

(11)

(See Instructions)

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this is a true, correct, and complete return, prepared in accordance

with the provisions of chapter 245, HRS, the Cigarette Tax and Tobacco Tax Law, and chapter 18-245, HAR.

SIGNATURE OF TAXPAYER OR DULY AUTHORIZED AGENT

DATE

(

)

PRINT OR TYPE NAME

DAYTIME PHONE NUMBER

If you file Form M-110, you MUST also file Form G-26, Use Tax Return,

to report and pay the use tax on cigarettes and tobacco products imported for consumption.

FORM M-110

1

1