Form Cd-1 - Instructions For Filing Articles Of Incorporation - 2009

ADVERTISEMENT

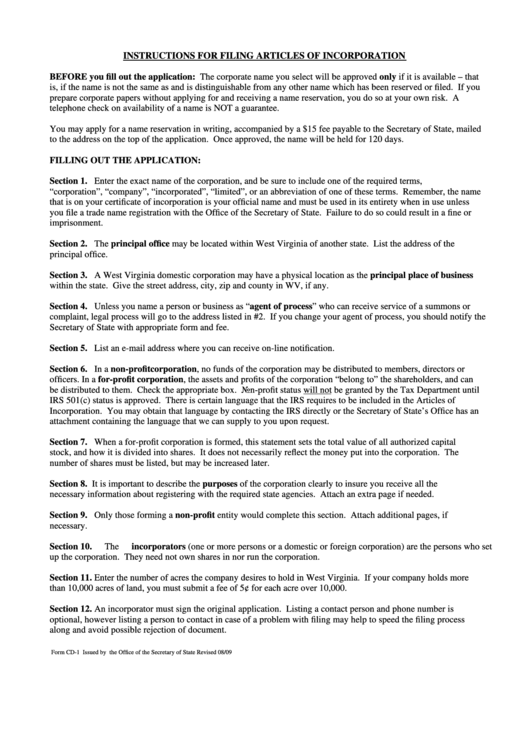

INSTRUCTIONS FOR FILING ARTICLES OF INCORPORATION

BEFORE you fill out the application: The corporate name you select will be approved only if it is available – that

is, if the name is not the same as and is distinguishable from any other name which has been reserved or filed. If you

prepare corporate papers without applying for and receiving a name reservation, you do so at your own risk. A

telephone check on availability of a name is NOT a guarantee.

You may apply for a name reservation in writing, accompanied by a $15 fee payable to the Secretary of State, mailed

to the address on the top of the application. Once approved, the name will be held for 120 days.

FILLING OUT THE APPLICATION:

Section 1.

Enter the exact name of the corporation, and be sure to include one of the required terms,

“corporation”, “company”, “incorporated”, “limited”, or an abbreviation of one of these terms. Remember, the name

that is on your certificate of incorporation is your official name and must be used in its entirety when in use unless

you file a trade name registration with the Office of the Secretary of State. Failure to do so could result in a fine or

imprisonment.

Section 2.

The principal office may be located within West Virginia of another state. List the address of the

principal office.

Section 3.

A West Virginia domestic corporation may have a physical location as the principal place of business

within the state. Give the street address, city, zip and county in WV, if any.

Section 4.

Unless you name a person or business as “agent of process” who can receive service of a summons or

complaint, legal process will go to the address listed in #2. If you change your agent of process, you should notify the

Secretary of State with appropriate form and fee.

Section 5.

List an e-mail address where you can receive on-line notification.

Section 6.

In a non-profit corporation, no funds of the corporation may be distributed to members, directors or

officers. In a for-profit corporation, the assets and profits of the corporation “belong to” the shareholders, and can

be distributed to them. Check the appropriate box. Non-profit status will not be granted by the Tax Department until

IRS 501(c) status is approved. There is certain language that the IRS requires to be included in the Articles of

Incorporation. You may obtain that language by contacting the IRS directly or the Secretary of State’s Office has an

attachment containing the language that we can supply to you upon request.

Section 7.

When a for-profit corporation is formed, this statement sets the total value of all authorized capital

stock, and how it is divided into shares. It does not necessarily reflect the money put into the corporation. The

number of shares must be listed, but may be increased later.

Section 8.

It is important to describe the purposes of the corporation clearly to insure you receive all the

necessary information about registering with the required state agencies. Attach an extra page if needed.

Section 9.

Only those forming a non-profit entity would complete this section. Attach additional pages, if

necessary.

Section 10.

The incorporators (one or more persons or a domestic or foreign corporation) are the persons who set

up the corporation. They need not own shares in nor run the corporation.

Section 11.

Enter the number of acres the company desires to hold in West Virginia. If your company holds more

than 10,000 acres of land, you must submit a fee of 5¢ for each acre over 10,000.

Section 12.

An incorporator must sign the original application. Listing a contact person and phone number is

optional, however listing a person to contact in case of a problem with filing may help to speed the filing process

along and avoid possible rejection of document.

Form CD-1

Issued by the Office of the Secretary of State

Revised 08/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2