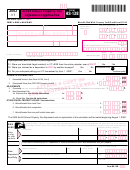

Instrictions for Completing Damaged Timber Application

WAC 458-40-660(4)

Item 6.

Describe the property with damaged timber by Section, Township and Range, and

subdivision to the nearest forty acres. The application must be accompanied by a map

for each harvest unit.

Item 7.

Estimate the total acreage for the damaged area.

Item 9.

Estimate the volumes by species with the best information available. Chipwood

volumes (CHW) are not adjusted and should be excluded. The actual volumes

adjusted will be determined by scaling when the timber is harvested.

Item 10. The timber must be damaged and the damage needs to cause the loss of stumpage

value to qualify for adjustment. Extra harvesting costs or loss of market value will be

considered for adjustment. Normal scaling deductions for defect are not taxed and

therefore do not qualify for adjustment.

Item 11. Provide a list of each estimated additional cost per thousand board foot ($/mbf) to be

incurred resulting from the removal of the damaged timber (for example, $15/mbf

additional for bucking, $5/mbf additional for sorting, etc.) The additional costs should

be an average for all species harvested.

Item 12. Adjustment for loss of market value requires documentation upon completion of the

harvest.

This application and the final adjustment amount must be approved by the Department of

Revenue before harvest begins.

Please mail completed form to:

Department of Revenue

Forest Tax Program

Attn: Operations Manager

PO Box 47472

Olympia WA 98504-7472

Or contact us at 1-800-548-8829 for further information.

To ask about the availability of this publication in an alternate format for the visually impaired, please call (360) 705-6715.

Teletype (TTY) users, please call (360) 705-6718.

REV 62 0082e (3/6/12)

1

1 2

2