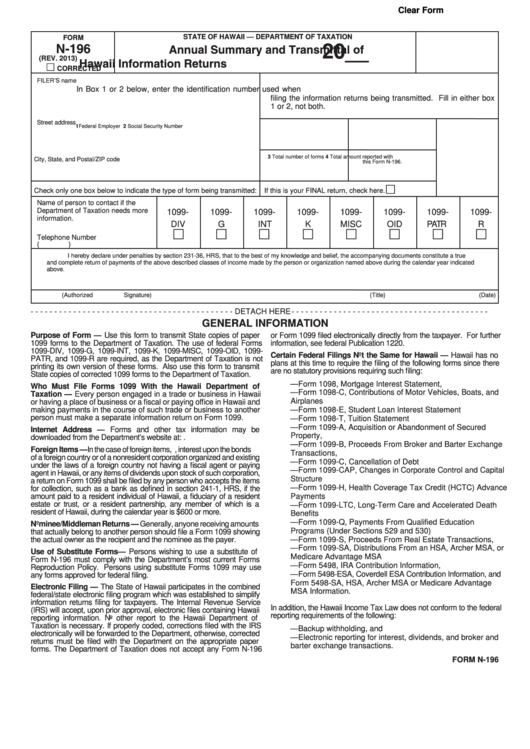

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

N-196

Annual Summary and Transmittal of

20__

Hawaii Information Returns

(REV. 2013)

CORRECTED

FILER’S name

In Box 1 or 2 below, enter the identification number used when

filing the information returns being transmitted. Fill in either box

1 or 2, not both.

Street address

1 Federal Employer I.D. Number

2 Social Security Number

3 Total number of forms

4 Total amount reported with

City, State, and Postal/ZIP code

this Form N-196.

Check only one box below to indicate the type of form being transmitted:

If this is your FINAL return, check here.

Name of person to contact if the

Department of Taxation needs more

1099-

1099-

1099-

1099-

1099-

1099-

1099-

1099-

information.

DIV

G

INT

K

MISC

OID

PATR

R

Telephone Number

(

)

I hereby declare under penalties by section 231-36, HRS, that to the best of my knowledge and belief, the accompanying documents constitute a true

and complete return of payments of the above described classes of income made by the person or organization named above during the calendar year indicated

above.

(Authorized Signature)

(Title)

(Date)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - DETACH HERE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

GENERAL INFORMATION

Purpose of Form — Use this form to transmit State copies of paper

or Form 1099 filed electronically directly from the taxpayer. For further

1099 forms to the Department of Taxation. The use of federal Forms

information, see federal Publication 1220.

1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-MISC, 1099-OID, 1099-

Certain Federal Filings Not the Same for Hawaii — Hawaii has no

PATR, and 1099-R are required, as the Department of Taxation is not

plans at this time to require the filing of the following forms since there

printing its own version of these forms. Also use this form to transmit

are no statutory provisions requiring such filing:

State copies of corrected 1099 forms to the Department of Taxation.

— Form 1098, Mortgage Interest Statement,

Who Must File Forms 1099 With the Hawaii Department of

— Form 1098-C, Contributions of Motor Vehicles, Boats, and

Taxation — Every person engaged in a trade or business in Hawaii

Airplanes

or having a place of business or a fiscal or paying office in Hawaii and

making payments in the course of such trade or business to another

— Form 1098-E, Student Loan Interest Statement

person must make a separate information return on Form 1099.

— Form 1098-T, Tuition Statement

— Form 1099-A, Acquisition or Abandonment of Secured

Internet Address — Forms and other tax information may be

Property,

downloaded from the Department’s website at: tax.hawaii.gov.

— Form 1099-B, Proceeds From Broker and Barter Exchange

Foreign Items — In the case of foreign items, i.e., interest upon the bonds

Transactions,

of a foreign country or of a nonresident corporation organized and existing

— Form 1099-C, Cancellation of Debt

under the laws of a foreign country not having a fiscal agent or paying

— Form 1099-CAP, Changes in Corporate Control and Capital

agent in Hawaii, or any items of dividends upon stock of such corporation,

Structure

a return on Form 1099 shall be filed by any person who accepts the items

— Form 1099-H, Health Coverage Tax Credit (HCTC) Advance

for collection, such as a bank as defined in section 241-1, HRS, if the

amount paid to a resident individual of Hawaii, a fiduciary of a resident

Payments

estate or trust, or a resident partnership, any member of which is a

— Form 1099-LTC, Long-Term Care and Accelerated Death

resident of Hawaii, during the calendar year is $600 or more.

Benefits

— Form 1099-Q, Payments From Qualified Education

Nominee/Middleman Returns — Generally, anyone receiving amounts

Programs (Under Sections 529 and 530)

that actually belong to another person should file a Form 1099 showing

the actual owner as the recipient and the nominee as the payer.

— Form 1099-S, Proceeds From Real Estate Transactions,

— Form 1099-SA, Distributions From an HSA, Archer MSA, or

Use of Substitute Forms — Persons wishing to use a substitute of

Medicare Advantage MSA

Form N-196 must comply with the Department’s most current Forms

— Form 5498, IRA Contribution Information,

Reproduction Policy. Persons using substitute Forms 1099 may use

— Form 5498-ESA, Coverdell ESA Contribution Information, and

any forms approved for federal filing.

Form 5498-SA, HSA, Archer MSA or Medicare Advantage

Electronic Filing — The State of Hawaii participates in the combined

MSA Information.

federal/state electronic filing program which was established to simplify

information returns filing for taxpayers. The Internal Revenue Service

In addition, the Hawaii Income Tax Law does not conform to the federal

(IRS) will accept, upon prior approval, electronic files containing Hawaii

reporting requirements of the following:

reporting information. No other report to the Hawaii Department of

Taxation is necessary. If properly coded, corrections filed with the IRS

— Backup withholding, and

electronically will be forwarded to the Department, otherwise, corrected

— Electronic reporting for interest, dividends, and broker and

returns must be filed with the Department on the appropriate paper

barter exchange transactions.

forms. The Department of Taxation does not accept any Form N-196

FORM N-196

1

1 2

2