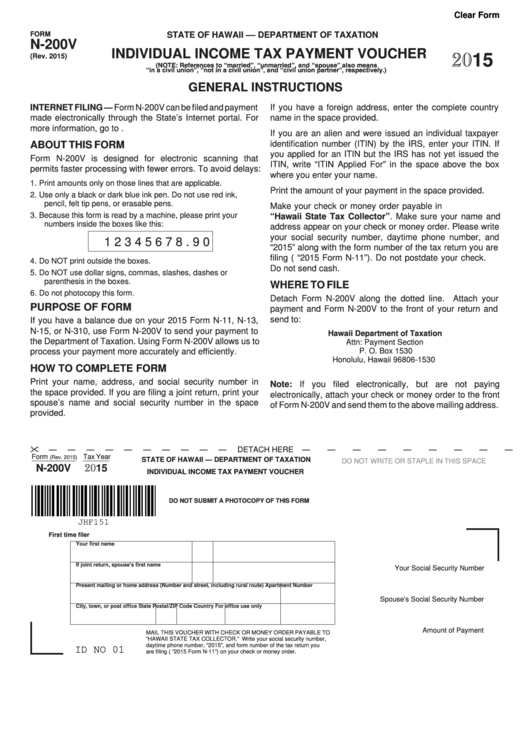

Clear Form

FORM

STATE OF HAWAII –– DEPARTMENT OF TAXATION

N-200V

INDIVIDUAL INCOME TAX PAYMENT VOUCHER

2015

(Rev. 2015)

(NOTE: References to “married”, “unmarried”, and “spouse” also means

“in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

GENERAL INSTRUCTIONS

INTERNET FILING — Form N-200V can be filed and payment

If you have a foreign address, enter the complete country

made electronically through the State’s Internet portal. For

name in the space provided.

more information, go to tax.hawaii.gov/eservices/.

If you are an alien and were issued an individual taxpayer

identification number (ITIN) by the IRS, enter your ITIN. If

ABOUT THIS FORM

you applied for an ITIN but the IRS has not yet issued the

Form N-200V is designed for electronic scanning that

ITIN, write “ITIN Applied For” in the space above the box

permits faster processing with fewer errors. To avoid delays:

where you enter your name.

1. Print amounts only on those lines that are applicable.

Print the amount of your payment in the space provided.

2. Use only a black or dark blue ink pen. Do not use red ink,

pencil, felt tip pens, or erasable pens.

Make your check or money order payable in U.S. dollars to

3. Because this form is read by a machine, please print your

“Hawaii State Tax Collector”. Make sure your name and

numbers inside the boxes like this:

address appear on your check or money order. Please write

your social security number, daytime phone number, and

1 2 3 4 5 6 7 8 . 9 0

“2015” along with the form number of the tax return you are

filing (e.g. “2015 Form N-11”). Do not postdate your check.

4. Do NOT print outside the boxes.

Do not send cash.

5. Do NOT use dollar signs, commas, slashes, dashes or

parenthesis in the boxes.

WHERE TO FILE

6. Do not photocopy this form.

Detach Form N-200V along the dotted line. Attach your

PURPOSE OF FORM

payment and Form N-200V to the front of your return and

send to:

If you have a balance due on your 2015 Form N-11, N-13,

N-15, or N-310, use Form N-200V to send your payment to

Hawaii Department of Taxation

the Department of Taxation. Using Form N-200V allows us to

Attn: Payment Section

P. O. Box 1530

process your payment more accurately and efficiently.

Honolulu, Hawaii 96806-1530

HOW TO COMPLETE FORM

Print your name, address, and social security number in

Note: If you filed electronically, but are not paying

the space provided. If you are filing a joint return, print your

electronically, attach your check or money order to the front

spouse’s name and social security number in the space

of Form N-200V and send them to the above mailing address.

provided.

DETACH HERE

Form

Tax Year

(Rev. 2015)

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

2015

N-200V

INDIVIDUAL INCOME TAX PAYMENT VOUCHER

DO NOT SUBMIT A PHOTOCOPY OF THIS FORM

JHF151

First time filer

Your first name

M.I.

Last name

If joint return, spouse’s first name

M.I.

Last name

Your Social Security Number

Present mailing or home address (Number and street, including rural route)

Apartment Number

Spouse’s Social Security Number

City, town, or post office

State

Postal/ZIP Code

Country

For office use only

Amount of Payment

MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO

“HAWAII STATE TAX COLLECTOR.” Write your social security number,

daytime phone number, “2015”, and form number of the tax return you

ID NO 01

are filing (e.g. “2015 Form N-11”) on your check or money order.

1

1