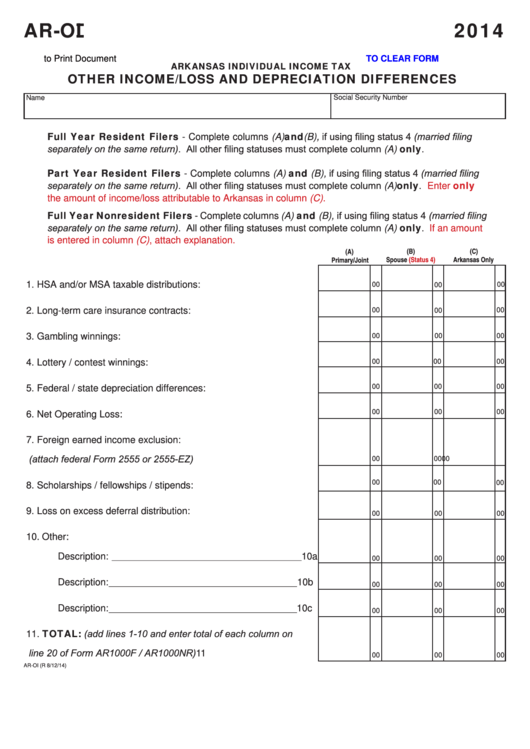

AR-OI

2014

Click Here to Print Document

CLICK HERE TO CLEAR FORM

ARKANSAS INDIVIDUAL INCOME TAX

OTHER INCOME/LOSS AND DEPRECIATION DIFFERENCES

Name

Social Security Number

Full Year Resident Filers - Complete columns (A) and (B), if using filing status 4 (married filing

separately on the same return). All other filing statuses must complete column (A) only.

Part Year Resident Filers - Complete columns (A) and (B), if using filing status 4 (married filing

separately on the same return). All other filing statuses must complete column (A) only.

Enter only

the amount of income/loss attributable to Arkansas in column (C).

Full Year Nonresident Filers - Complete columns (A) and (B), if using filing status 4 (married filing

separately on the same return). All other filing statuses must complete column (A) only.

If an amount

is entered in column (C), attach explanation.

(B)

(C)

(A)

Arkansas Only

Primary/Joint

Spouse

(Status 4)

1. HSA and/or MSA taxable distributions: .......................................1

00

00

00

2. Long-term care insurance contracts: ..........................................2

00

00

00

3. Gambling winnings: ....................................................................3

00

00

00

4. Lottery / contest winnings: ..........................................................4

00

00

00

00

00

00

5. Federal / state depreciation differences: ....................................5

00

00

00

6. Net Operating Loss: ....................................................................6

7. Foreign earned income exclusion:

(attach federal Form 2555 or 2555-EZ) ......................................7

00

00

00

00

00

00

8. Scholarships / fellowships / stipends: .........................................8

9. Loss on excess deferral distribution: ..........................................9

00

00

00

10. Other:

Description:

10a

________________________________________________

00

00

00

Description:

10b

_______________________________________

00

00

00

Description:

10c

_______________________________________

00

00

00

11. TOTAL: (add lines 1-10 and enter total of each column on

line 20 of Form AR1000F / AR1000NR) ...................................11

00

00

00

AR-OI (R 8/12/14)

1

1