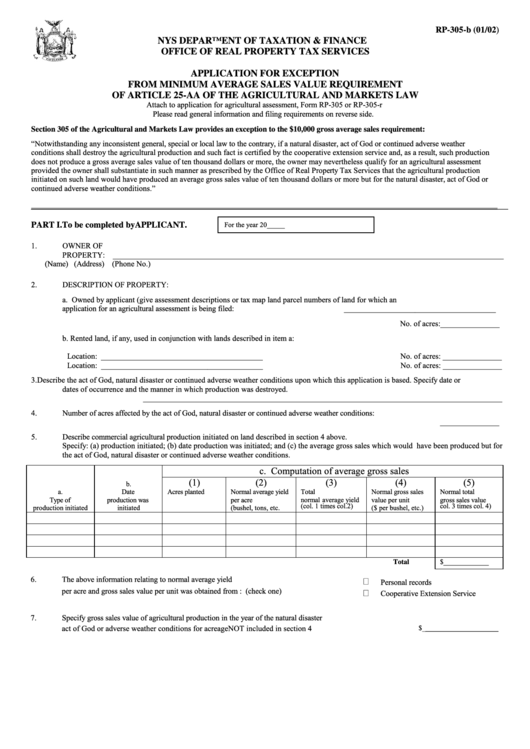

RP-305-b (01/02)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR EXCEPTION

FROM MINIMUM AVERAGE SALES VALUE REQUIREMENT

OF ARTICLE 25-AA OF THE AGRICULTURAL AND MARKETS LAW

Attach to application for agricultural assessment, Form RP-305 or RP-305-r

Please read general information and filing requirements on reverse side.

Section 305 of the Agricultural and Markets Law provides an exception to the $10,000 gross average sales requirement:

“Notwithstanding any inconsistent general, special or local law to the contrary, if a natural disaster, act of God or continued adverse weather

conditions shall destroy the agricultural production and such fact is certified by the cooperative extension service and, as a result, such production

does not produce a gross average sales value of ten thousand dollars or more, the owner may nevertheless qualify for an agricultural assessment

provided the owner shall substantiate in such manner as prescribed by the Office of Real Property Tax Services that the agricultural production

initiated on such land would have produced an average gross sales value of ten thousand dollars or more but for the natural disaster, act of God or

continued adverse weather conditions.”

__________________________________________________________________________________________________

For the year 20_____

PART I. To be completed by APPLICANT.

1.

OWNER OF

PROPERTY: ___________________________________________________________________________________________________

(Name)

(Address)

(Phone No.)

2.

DESCRIPTION OF PROPERTY:

a. Owned by applicant (give assessment descriptions or tax map land parcel numbers of land for which an

application for an agricultural assessment is being filed:

_______________________________________

No. of acres:_______________

b. Rented land, if any, used in conjunction with lands described in item a:

Location: _________________________________________

No. of acres: _______________

Location: _________________________________________

No. of acres: _______________

3.

Describe the act of God, natural disaster or continued adverse weather conditions upon which this application is based. Specify date or

dates of occurrence and the manner in which production was destroyed.

___________________________________________________________________________________________

4.

Number of acres affected by the act of God, natural disaster or continued adverse weather conditions:

_______________

5.

Describe commercial agricultural production initiated on land described in section 4 above.

Specify: (a) production initiated; (b) date production was initiated; and (c) the average gross sales which would have been produced but for

the act of God, natural disaster or continued adverse weather conditions.

c. Computation of average gross sales

(1)

(2)

(3)

(4)

(5)

b.

a.

Date

Acres planted

Normal average yield

Total

Normal gross sales

Normal total

Type of

production was

per acre

normal average yield

value per unit

gross sales value

production initiated

initiated

(bushel, tons, etc.

(col. 1 times col.2)

($ per bushel, etc.)

col. 3 times col. 4)

$_____________

Total

6.

The above information relating to normal average yield

Personal records

per acre and gross sales value per unit was obtained from : (check one)

Cooperative Extension Service

7.

Specify gross sales value of agricultural production in the year of the natural disaster

act of God or adverse weather conditions for acreage NOT included in section 4

$_

_____________________

1

1 2

2