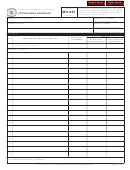

FORM

N-304

(REV. 2004)

CHANGES IN STOCK HOLDINGS DURING THE YEAR

CORPORATION

CHANGES IN STOCK HOLDINGS DURING THE YEAR

Changes

STOCK-

Shares held at

HOLDER

Shares acquired

Shares disposed of

end of year

(Corporation

Date

Voting

Nonvoting

No.

Name

No.)*

Voting

Nonvoting

Voting

Nonvoting

Percent

voting

Percent

power

of value

*The numbers used must agree with the corporation number on front.

In case additional stock was issued, or if any stock was retired during the year, dates and amounts of such transactions should be shown.

If the equitable owners of any capital stock shown above were other than the holders of record, full details must be given.

Remarks:

SIGNATURE

I declare, under the penalties set forth in section 231-36, HRS, that the above information and statements have been examined by me and are, to the

best of my knowledge and belief, true, correct, and complete for the taxable year as stated.

Affix

Corporate

Seal

Here

Signature of Officer

Date

Title

An affiliated group of corporations, within the meaning of section 235-92(2), HRS, (IRC section 1504) is formed at the time that the common parent corporation which is an

includible corporation becomes the owner directly of stock possessing at least 80 percent of the voting power of all classes of stock and at least 80 percent of each class of the

nonvoting stock (not including nonvoting stock which is limited and preferred as to dividends) of another includible corporation. A corporation becomes a member of such an

affiliated group at the time that one or more members of such group become the owners directly of stock possessing at least 80 percent of the voting power of all classes of its

stock and at least 80 percent of each class of its nonvoting stock (not including nonvoting stock which is limited and preferred as to dividends). A corporation ceases to be a

member of such an affiliated group at the time the members of such group cease to own directly stock possessing at least 80 percent of the voting power of all classes of its

stock, or at least 80 percent of each class of its nonvoting stock (not including stock which is limited and preferred as to dividends).

1

1 2

2