Form F-851 - Corporate Income/franchise Tax Affiliations Schedule Page 2

ADVERTISEMENT

F-851

R. 01/13

Page 2

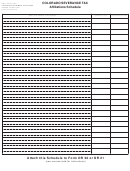

Schedule of Consolidated Changes

PART II

Use the schedule below to record any changes that occurred during the tax year that caused the corporations included in the

consolidated return to change. List all affected corporations and indicate whether they are deletions or additions by checking the correct

box. Deletions are any subsidiary members that are no longer included in the consolidated return but were included in last year’s return.

3 One

Does corporation have

Florida:

Property?

Payroll?

Sales?

NAICS Code

FEIN

Name of Corporation

(Yes/No)

(Yes/No)

(Yes/No)

-

-

-

-

-

-

-

-

-

-

Contact Us

Information, forms, and tutorials are available on our Internet site:

To speak with a Department representative, call Taxpayer Services, Monday through Friday, 8 a.m. to

7 p.m., ET, at 800-352-3671.

To find a taxpayer service center near you, go to: /contact.html

For written replies to tax questions, write to:

Taxpayer Services - Mail Stop 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0112

Subscribe to our tax publications to receive due date reminders or an e-mail when we post:

• Tax Information Publications (TIPs).

• Facts on Tax, a quarterly publication.

• Proposed rules, notices of rule development workshops, and more.

Go to: /list/

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2