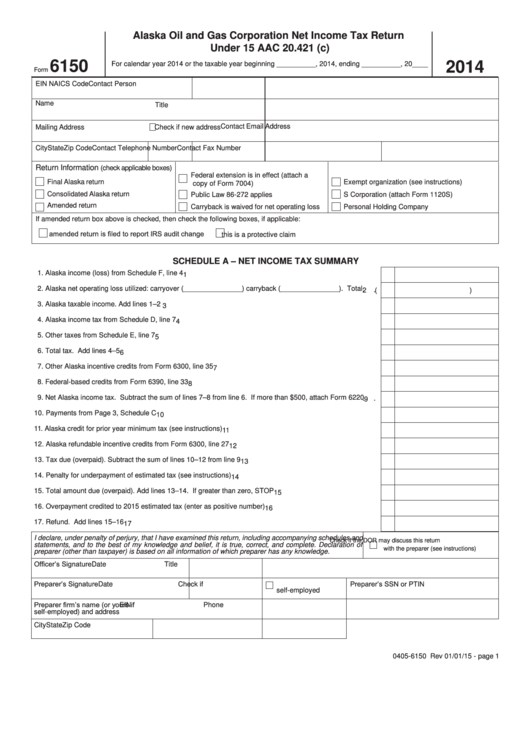

Form 6150 - Alaska Oil And Gas Corporation Net Income Tax Return - 2014

ADVERTISEMENT

Alaska Oil and Gas Corporation Net Income Tax Return

Under 15 AAC 20.421 (c)

6150

2014

For calendar year 2014 or the taxable year beginning __________, 2014, ending __________, 20____

Form

EIN

NAICS Code

Contact Person

Name

Title

Contact Email Address

Mailing Address

Check if new address

City

State

Zip Code

Contact Telephone Number

Contact Fax Number

Return Information

(check applicable boxes)

Federal extension is in effect (attach a

Final Alaska return

Exempt organization (see instructions)

copy of Form 7004)

Consolidated Alaska return

Public Law 86-272 applies

S Corporation (attach Form 1120S)

Amended return

Carryback is waived for net operating loss

Personal Holding Company

If amended return box above is checked, then check the following boxes, if applicable:

amended return is filed to report IRS audit change

this is a protective claim

SCHEDULE A – NET INCOME TAX SUMMARY

1. Alaska income (loss) from Schedule F, line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2. Alaska net operating loss utilized: carryover (_______________) carryback (_______________). Total

.

.

2

(

)

3. Alaska taxable income. Add lines 1–2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4. Alaska income tax from Schedule D, line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5. Other taxes from Schedule E, line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6. Total tax. Add lines 4–5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7. Other Alaska incentive credits from Form 6300, line 35

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8. Federal-based credits from Form 6390, line 33

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9. Net Alaska income tax. Subtract the sum of lines 7–8 from line 6. If more than $500, attach Form 6220

.

.

9

10. Payments from Page 3, Schedule C

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11. Alaska credit for prior year minimum tax (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

12. Alaska refundable incentive credits from Form 6300, line 27

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13. Tax due (overpaid). Subtract the sum of lines 10–12 from line 9

.

.

.

.

.

.

.

.

.

.

.

.

.

13

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14. Penalty for underpayment of estimated tax (see instructions)

14

.

.

.

.

.

.

.

.

.

.

15. Total amount due (overpaid). Add lines 13–14. If greater than zero, STOP

15

16. Overpayment credited to 2015 estimated tax (enter as positive number)

.

.

.

.

.

.

.

.

.

.

.

16

17. Refund. Add lines 15–16

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

I declare, under penalty of perjury, that I have examined this return, including accompanying schedules and

Check if the DOR may discuss this return

statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of

with the preparer (see instructions)

preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Officer’s Signature

Date

Title

Preparer’s Signature

Preparer’s SSN or PTIN

Date

Check if

self-employed

Preparer firm’s name (or yours if

EIN

Phone

self-employed) and address

City

State

Zip Code

0405-6150 Rev 01/01/15 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9