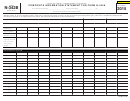

Form N-342A

(REV. 2015)

Page 2

21. Actual per unit cost of the solar energy system. (Multiply line 19 by line 20 and enter result.).

21

22. Enter 35% of line 21 or $350, whichever is less. .......................................................................

22

23. Multiply line 22 by the number of units you own to which the allocated unit cost on line 21

is applicable. (Number of units you own __________ ). .............................................................................................................

23

24. Enter the amount from line 3 that is installed and placed in service in Hawaii on commercial property. ..............

24

25. Enter 35% of line 24 or $500,000, whichever is less. .................................................................................................................

25

26. Add lines 18, 23, and 25, and enter result (but not less than zero). ...........................................................................................

26

Enter date system was installed and placed in service

____/____/____

WIND-POWERED ENERGY SYSTEM

27. Enter your total cost of the qualified wind-powered energy system installed and placed in

service in Hawaii. ......................................................................................................................

27

28. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying wind-powered energy system. ..................................

28

29. Actual cost of the wind-powered energy system (Subtract line 28 from line 27 and enter result.). ........

29

30. Enter the amount from line 29 that is installed and placed in service in Hawaii on

single-family residential property. ..........................................................................................

30

31. Enter 20% of line 30 or $1,500, whichever is less. .....................................................................................................................

31

32. Enter the amount from line 29 that is installed and placed in service in Hawaii on multi-family residential property. 32

33. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). ......

33

34. Actual per unit cost of the wind-powered energy system. (Multiply line 32 by line 33 and

enter result.). .............................................................................................................................

34

35. Enter 20% of line 34 or $200, whichever is less .......................................................................

35

36. Multiply line 35 by the number of units you own to which the allocated unit cost on line 34

is applicable. (Number of units you own __________ ). .............................................................................................................

36

37. Enter the amount from line 29 that is installed and placed in service in Hawaii on commercial property. ............

37

38. Enter 20% of line 37 or $500,000, whichever is less. .................................................................................................................

38

39. Add lines 31, 36, and 38, and enter result (but not less than zero). ...........................................................................................

39

TOTAL AND DISTRIBUTIVE SHARE OF RENEWABLE ENERGY TECHNOLOGIES INCOME TAX CREDIT

40. Total tax credit claimed. Enter the amount from line 14, 26, or 39. ............................................................................................

40

41. Distributive share of solar energy tax credit. Each shareholder, partner, member, or beneficiary shall enter this amount

on Form N-342, line 40. .............................................................................................................................................................

41

42. Distributive share of wind-powered energy tax credit. Each shareholder, partner, member, or beneficiary shall enter this

amount on Form N-342, line 41..................................................................................................................................................

42

If the above per unit cost calculation does not fairly represent the owners’

GENERAL INSTRUCTIONS

contribution to the cost of the system, provide an alternative calculation.

For requirements for claiming the renewable energy technologies income

tax credit and definitions, see the Instructions for Form N-342.

Line 41 — Distributive share of solar energy tax credit. Each individual

and corporate shareholder, partner, member, or beneficiary of an S corporation,

SPECIFIC INSTRUCTIONS

partnership, estate, trust, or condominium apartment association receiving a

Complete one Form N-342A for each individual and corporate shareholder,

Form N-342A must enter this amount on Form N-342, line 40. Both the Form

partner, member, or beneficiary receiving a distributive share of the renewable

N-342 and a copy of the Form N-342A must be attached to the individual or

energy technologies income tax credit. Use a separate form for each eligible

corporate income tax return on which the credit is claimed.

system. Attach a copy of the Forms N-342A as issued to each partner, member,

Line 42 — Distributive share of wind-powered energy tax credit. Each

beneficiary, or shareholder to the return of the S corporation, partnership,

individual and corporate shareholder, partner, member, or beneficiary of an S

estate, trust, or condominium apartment association.

corporation, partnership, estate, trust, or condominium apartment association

Be sure to enter in the appropriate space (1) the physical property address

receiving a Form N-342A must enter this amount on Form N-342, line 41.

where the system was installed and placed in service, (2) the date the system

Both the Form N-342 and a copy of the Form N-342A must be attached to the

was installed and placed in service, and (3) the Total Output Capacity, if the

individual or corporate income tax return on which the credit is claimed.

credit being claimed is for an “other solar energy system”.

COMPOSITE FILING OF FORM N-342A

Lines 1 through 40 — Fill in the lines as they apply to your claim.

For taxable years that begin on or after January 1, 2011, any S corporation,

Lines 1 or 27 –– Enter the qualifying cost of the eligible renewable energy

partnership, estate, trust, or condominium apartment association that has

technology system installed and placed in service in Hawaii.

installed and placed in service 10 or more systems in a single taxable year

Lines 2 or 28 –– Enter the dollar amount of any consumer incentive

may file composite Form(s) N-342A. A composite Form N-342A, which is

premiums unrelated to the operation of the system or offered with the sale of

designated with the word “COMPOSITE” printed in capital letters at the top of

the system (such as “free solar powered products”, “free gifts”, offers to pay

the form, is used to report the total amounts from Form N-342B, Composite

electricity bills, or rebates), costs for which another credit is claimed, and any

Information Statement for Form N-342A. For more information and instructions

utility rebate received for the qualifying renewable energy technology system.

on filing a composite Form N-342A, see Department of Taxation Announcement

No. 2012-01 and the Instructions for Form N-342B.

These dollar amounts are to be deducted from the cost of the qualifying

system before determining the credit.

Lines 8, 20, and 33 –– The per unit cost of a solar or wind-powered energy

system installed and placed in service in Hawaii in a multi-family residential

property may be determined as follows:

Total square feet of your unit

Total square feet of all units in the

x The actual cost

multi-family residential property

of the system

FORM N-342A

1

1 2

2